Appearance

What is Hong Kong Deposit Protection Scheme (DPS)

What is a Deposit Protection Scheme(DPS) in Hong Kong?

DPS stands for Deposit Protection Scheme.

Hong Kong Deposit Protection Board (the Board) is an independent statutory body formed under the Deposit Protection Scheme Ordinance to oversee the operation of the Deposit Protection Scheme (DPS).

In case a member bank of DPS (a Scheme member) fails, the DPS will pay compensation to each depositor of the failed Scheme member.

What is the protection limit under DPS?

The protection limit of DPS was raised from its original level of HK$100,000 per depositor per bank to the current HK$500,000 per depositor per bank in 2011, including both principal and interest.

It is expected to be raised to HK$800,000 per depositor per bank in the fourth quarter of 2024.

信息

If you divide your deposit and maintain it with different banks, you will get more protections from DFS.

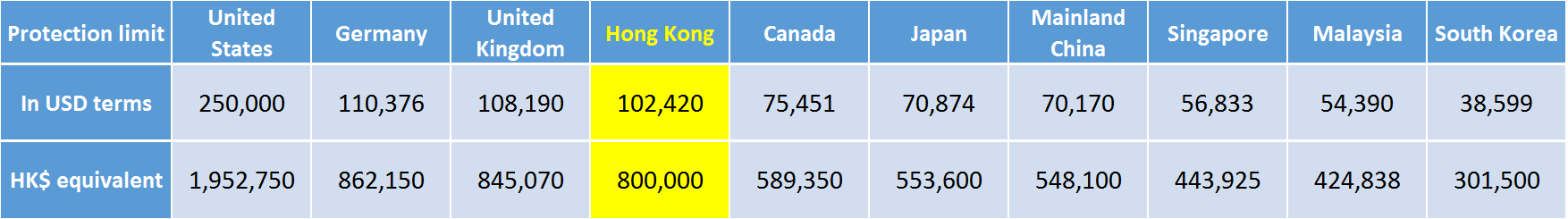

What are the protection limits of other economies?

Note: Based on exchange rates as at end-December 2023. The US and Canada provide deposit protection on a “per account category” basis, while all other jurisdictions provide deposit protection on a “per depositor per bank” basis.

What are financial products protected by the DPS?

All deposits denominated in Hong Kong dollars, Renminbi or any other currency deposits held with the Hong Kong Offices of a Scheme member are protected.

The following types of deposits are protected:

- ✅ Conventional deposits with Scheme members (e.g. savings deposits, current account deposits and time deposits with a term not more than 5 years)

- ✅ Deposits held by individuals (including joint account) or corporations

- ✅ Secured / pledged deposits

The following types of deposits are not protected:

- ❌ Structured deposits (e.g. foreign currency linked deposits and equity link deposits)

- ❌ Time deposits with a maturity longer than 5 years

- ❌ Bearer instruments (e.g. bearer certificates of deposit)

- ❌ Offshore deposits (e.g. deposits with overseas / mainland China offices of a Scheme member)

- ❌ Deposits the repayment of which are secured on the assets of the Scheme member

- ❌ Deposits held for the account of the Exchange Fund

- ❌ Deposits held or owned by an excluded person

Other financial products such as bonds, stocks, warrants, mutual funds, unit trusts and insurance policies are not protected by the DPS.

What is a structured deposit?

Structured deposits can take many different forms. Typical examples of structured deposits are foreign currency linked deposits and equity linked deposits. The amounts of principal and/or interest to be repaid for such deposits are linked to the performance of the underlying financial assets.

What is a bearer instrument?

A bearer instrument, in simple terms, is a financial instrument where the holder of the instrument is entitled to the repayment of the money underlying the instrument. A typical example of a bearer instrument is a bearer certificate of deposit, where the holder of the certificate evidencing the deposit is entitled to the repayment of the principal from the issuing bank, whether or not he or she is the person who made the deposit at the beginning.

What is the size of the DPS Fund?

The target size of the DPS Fund is 0.25% of the aggregate amount of protected deposits in the banking sector.

The Fund can only be invested in deposits with the Exchange Fund, Exchange Fund Bills, US Treasury Bills, and other investments approved by the Financial Secretary, and exchange rate and interest rate contracts for hedging purpose.

The Board has secured a credit facility from the Exchange Fund for the purpose of paying compensation to depositors in the event of a bank failure. The size of the credit facility is sufficient to cope with the simultaneous failures of two medium-sized banks.

Who is a Scheme member of the DPS?

List of Scheme members --- they must display the following membership sign at their places of business.

What should I do if my bank failed?

Depositors do not need to file claim with the Board. The Board will examine the records of the Scheme member to identify eligible depositors and calculate the compensation amounts.

When compensation under the DPS is triggered in respect of a Scheme member, the Board will inform the depositors of the Scheme member by notice published in major newspapers or by a means which the Board considers appropriate in the circumstances.

The Board will pay compensation to depositors as soon as practicable in the event of a bank failure. The exact timing will however vary from case to case. Where appropriate, the Board has a target of one week in making payments to depositors.