Appearance

Investment Articles

- Principal Trading vs Agency Trading

- What is a CUSIP Number

- What is a SWIFT/BIC Code

- How to calculate IRR(Internal Rate of Return) in Excel

- List of Bank Card Networks

- Acronyms in Finance

- GIC and Bridgewater Identify the Major Issues Facing Investors in the Years Ahead — Transcript

- Nasdaq TotalView

- IBKR Smart Routing

- Top Asset Management Firms

- OTC Markets Group

- US Federal's Interest Rate History

- NS-CMIC, 1260H and Entity List

- Top Asset Management Firms

- U.S. Dollar Index(USDX/DXY)

- Stock Exchanges in the World

- SIPC(Securities Investor Protection Corporation)

- Commoditize Your Complement

Tech

- Stanford ECON295⧸CS323 2024 The Age of AI, Eric Schmidt

- 2025-07-23 WHITE HOUSE UNVEILS AMERICA’S AI ACTION PLAN

- 2025-07-23 Winning the Race: AMERICA’S AI ACTION PLAN

- AI.GOV

ETF

- S&P 500 Sectors & ETF List

- US Treasury ETF List

- Dividend ETF List

- Cryptocurrency ETF List

- Covered Call ETF List

- CSOP南方东英香港ETF产品

- 基金申购费计算方式

Option

U.S.

China

ETF

Vanguard announced today that its Board of Directors has appointed Salim Ramji, a longtime financial services executive, as the Company's new Chief Executive Officer and a member of the Board, effective July 8, 2024. Mr. Ramji succeeds Tim Buckley, who, as previously announced, will retire and step down as Chairman and CEO.

Most recently, Mr. Ramji was Global Head of iShares & Index Investing, where he was responsible for managing a majority of the firm's client assets and evolving the iShares platform to provide an even broader set of innovative low-cost products for investors globally.

With Ramji overseeing the approval and launch of BlackRock’s spot Bitcoin (BTC) exchange-traded fund (ETF) earlier this year, his May 14 appointment to Vanguard has industry pundits wondering whether he will try to change the firm’s long-held opposition to Bitcoin or even spark a late filing for a spot Bitcoin ETF.

“Our perspective is that these products do not align with our offer focused on asset classes such as equities, bonds, and cash, which Vanguard views as the building blocks of a well-balanced, long-term investment portfolio.”

Lefkovitz: Crypto is an area where, before your arrival, Vanguard kind of drew a line in the sand and refused to add cryptocurrency ETFs to the platform. I’m curious how what the decision-making framework is like, how you go about approaching a new sort of asset class or asset.

Ramji: Yeah, it was pretty straightforward. And, you know, Greg Davis, our CIO, and I had talked about it kind of early in my arrival. And at Vanguard, we like things that, we like investments that deliver cash flow or have the prospect of delivering cash flow. That could be cash, could be bonds, could be equities, could, over time, if the circumstances are right, be private markets. We don’t like things that don’t. We don’t have a gold ETF. We don’t have a silver ETF. And so it’s a logical extension then as to why we don’t have ETFs in other things that don’t either deliver cash flow or have the prospect of delivering cash flow. And that’s OK. The market’s well served. Investors can decide. But we also want to be clear about what our own investing philosophy and our own investing thinking is. And we’re OK not being everything to everybody. And there are certain things like either we don’t fit our investment philosophy or we don’t think we have particular scale or expertise in. And so that’s where I’d put some of those types of ETFs in that bucket.

Hong Kong

- What is The Fast Payment System(FPS,转数快)

- What does RTGS/CHATS mean in Hong Kong (特快转账)

- What is eDDA(Electronic Direct Debit Authorization) in Hong Kong

- Linked Exchange Rate System(LERS) in Hong Kong

- What is the Format of Bank Account Number in Hong Kong

- What is Hong Kong Deposit Protection Scheme (DPS)

- 香港居民免税额、扣除及税率表

- Hong Kong Visas / Entry Permits

- 中银香港汇款指南

- 汇丰银行(香港)汇款指南

- 香港保险公司缴纳保费汇率

- SFC(Securities & Futures Commission of Hong Kong) Licenses

- 香港强积金基金平台

- 香港强积金核准受托人列表

- 香港强积金计划资产规模

Europe

Asia

International

Insurance

- 香港保险中介人资格考试(IIQE)卷一:保险原理及实务

- 香港保险中介人资格考试(IIQE)卷三:长期保险

- 香港保险中介人资格考试(IIQE)卷四:强积金

- 香港保险中介人资格考试(IIQE)卷五:投资相连长期保险

- Indexed Universal Life Insurance 指数万用寿险

- 加拿大税务居民保险税务问题

- Private Equity and Life Insurers

内地保险

- 2025-04-25 国家金融监督管理总局关于加强万能型人身保险监管有关事项的通知

保险公司为强化资产负债管理、保障客户长期利益,可以对万能险最低保证利率设置保证期间,保证期满以后可以合理调整最低保证利率。 保险公司在销售此类产品时应当向客户充分提示风险,在调整最低保证利率时应当及时告知调整原因并做好客户服务。

- 2025-04-27 规范万能险产品发展新规发布

所谓万能险,是指在产品名称中包含“万能型”字样、可灵活缴纳保费、可调整保险保障水平,兼有保障和投资功能的保险产品。万能险利率包含保证利率和结算利率。其中,保证利率目前是不超过1.5%; 结算利率则是保险公司根据万能账户的投资情况确定上月的实际利率,与保险公司投资收益有着强关联性,存在不确定性,但不会低于最低保证利率。

据不完全统计,我国保险市场上共有上千款万能险产品。人身险公司一般都有多款万能险产品,且每款万能险结算水平不同。近日,人身险公司公布的数据显示,万能险产品2025年3月份的结算利率与上年同期有所下降,且很多产品结算利率降至3%以下。

Tools

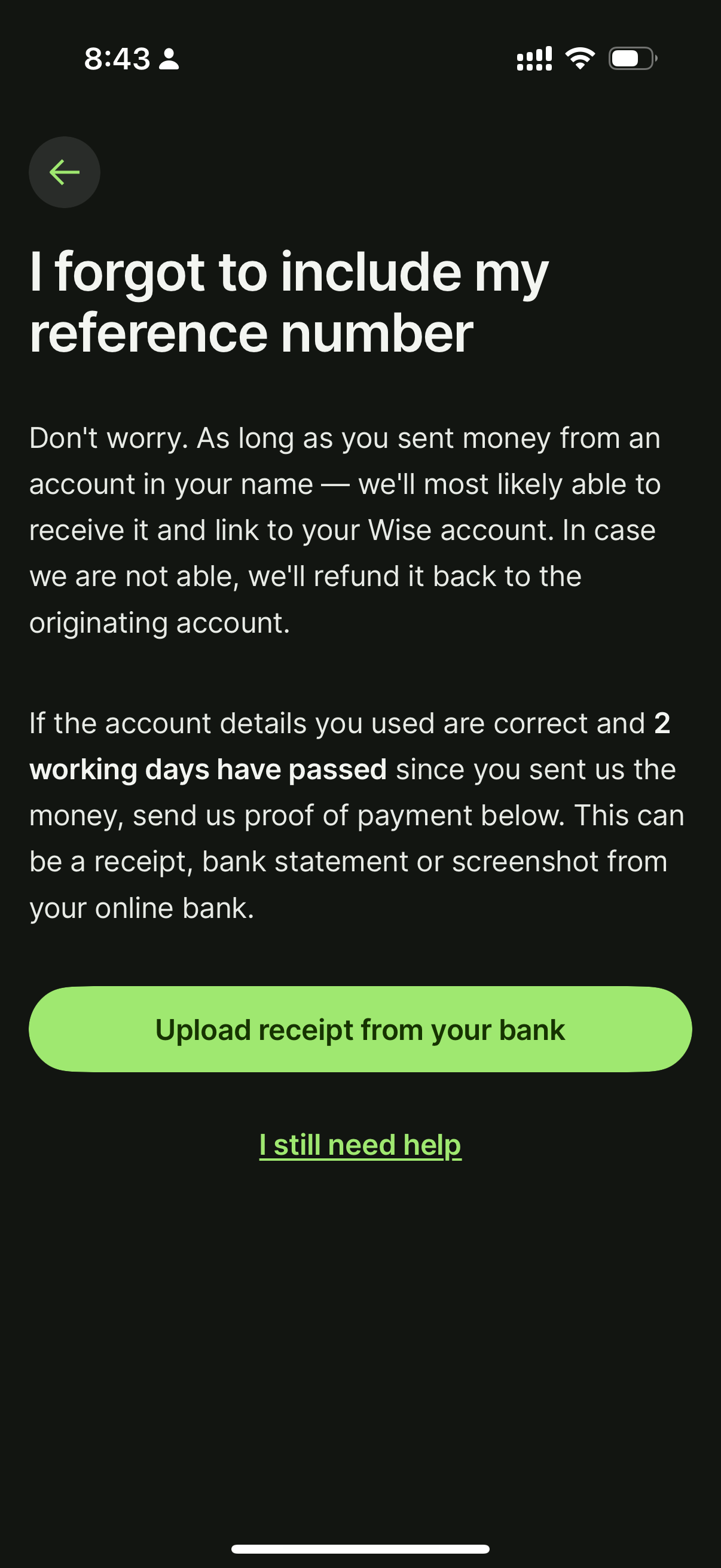

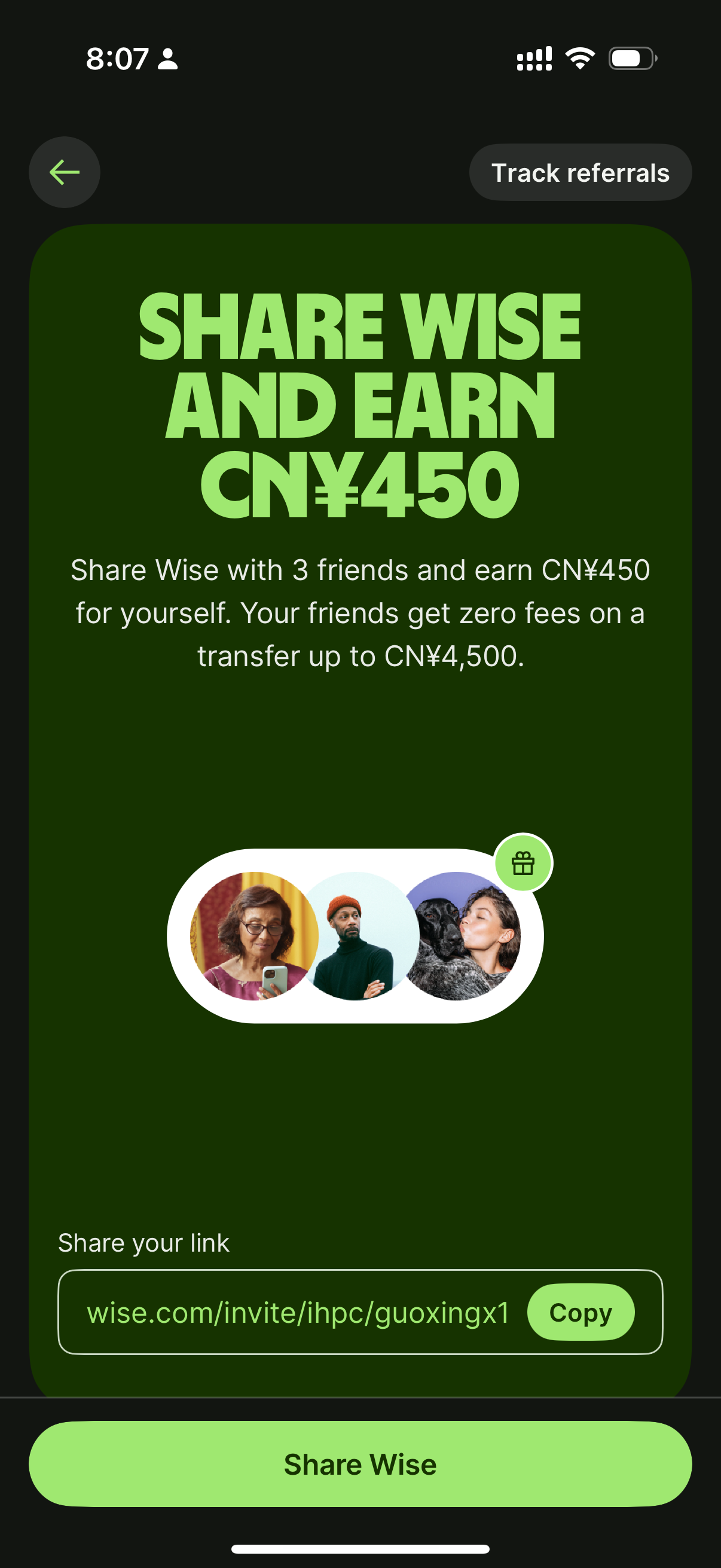

Wise

Resource

- DataRoma

- Stockcircle

- TradingView

- ETF Research Center

- barchart.com

- factset.com

- Portfolio Visualizer

- 理杏仁

- Norges Bank Investment Management

- Chevy Chase Trust Holdings, Inc. Portfolio Holdings

- Dividend Growth Investor

- Dividend Growth Investor Newsletter

- Dividend.com

- TOP 500

- 挪威主权基金 Norges Bank Investment Management

- ETF数据库 eft.com

- ETF数据库 eftdb.com

- CEF(Closed-End Fund) Connect

- 标普500涨跌Map Finviz - Financial Visualizations

- Shiller PE Ratio multpl - Market, Financial, and Economic Data

- Bitcoin Ahr999 Index

- 找图

- 信报财经新闻

- 信报 Tech

- 集思录

- Polymarket