Appearance

Option Strategies

- At the Money (ATM):

- In the Money (ITM):

- Call Option:

- Put Option:

- Out the Money (OTM)

- Call Option:

- Put Option:

Long Call

Short Call

Long Put

Short Put

Cash Secured Put (CSP)

- Always write a CSP when the stock is down. You get a better premium.

- Always write a CSP of a stock you don't mind owning.

- If it does get assigned, then you can write covered calls and do the reverse.

- if the stock keeps going higher, you pocket the premium.

Income Strategies

Covered Call(CC)

| Strategy Details | |

|---|---|

| Strategy Type | Cautiously Bullish |

| # of legs | 2 (Long the Underlying + Short OTM Call) |

Covered Put

Vertical Spreads

Bull Call Spread

Bear Call Spread

Bear Put Spread

| Strategy Details | |

|---|---|

| Strategy Type | Moderately bearish |

| # of legs | 2 (Long ATM Put + Short OTM Put) |

| Maximum Risk | Premium(long Put - short Put) |

| Maxinum Reward | Strike Price(long Put - short Put) - Premium(long Put - short Put) |

Bull Put Spread

| Strategy Details | |

|---|---|

| Strategy Type | Moderately bullish |

| # of legs | 2 (Short OTM Put (high strike) + Long OTM Put(low strike)) |

| Maximum Risk | Strike Price(short Put - long Put) - Premium(long Put - short Put) |

| Maxinum Reward | Premium(long Put - short Put) |

Protection Strategies

Married Put

Protective Collar

Horizontal Strategies

Long Call Calendar

Long Put Calendar

Long Call Diagonal

Short Call Diagonal

Long Put Diagonal

Short Put Diagonal

Straddle and Strangle

Long Straddle

| Strategy Details | |

|---|---|

| Strategy Type | Neutral on direction, but bullish on volatility |

| # of legs | 2 (Long ATM Call + Long ATM Put) |

| Maximum Risk | Limited to the extent of net premium paid |

| Maxinum Reward | Potentially unlimited |

Short Straddle

| Strategy Details | |

|---|---|

| Strategy Type | Neutral on direction, but bearish on volatility |

| # of legs | 2 (Short ATM Call + Short ATM Put) |

| Maximum Risk | Potentially unlimited |

| Maxinum Reward | Limited to the extent of net premium received |

Long Strangle

| Strategy Details | |

|---|---|

| Strategy Type | Neutral on direction, but bullish on volatility |

| # of legs | 2 (Long OTM Call + Long OTM Put) |

| Maximum Risk | Limited to the extent of net premium paid |

| Maxinum Reward | Potentially unlimited |

Short Strangle

| Strategy Details | |

|---|---|

| Strategy Type | Neutral on direction, but bearish on volatility |

| # of legs | 2 (Short OTM Call + Short OTM Put) |

| Maximum Risk | Potentially unlimited |

| Maxinum Reward | Limited to the extent of net premium received |

Butterfly Strategies

Long Call Butterfly

Short Call Butterfly

Long Put Butterfly

Short Put Butterfly

Long Iron Butterfly

Short Iron Butterfly

Condor Strategies

Long Call Condor

Short Call Condor

Long Put Condor

Options:

- Buy a put option at a lower and out-of-the-money (OTM) strike price (

Put 1). - Sell a put option at a lower middle and out-of-the-money (OTM) strike price (

Put 2). - Sell a put option at a higher middle and in-of-the-money (ITM) strike price (

Put 3). - Buy a put option at a higher and in-of-the-money (ITM) strike price (

Put 4).

- Buy a put option at a lower and out-of-the-money (OTM) strike price (

Strike Price:

- Expiration date: Same

Short Put Condor

Options:

- Sell a put option at a lower and out-of-the-money (OTM) strike price (

Put 1). - Buy a put option at a lower middle and out-of-the-money (OTM) strike price (

Put 2). - Buy a put option at a higher middle and in-of-the-money (ITM) strike price (

Put 3). - Sell a put option at a higher and in-of-the-money (ITM) strike price (

Put 4).

- Sell a put option at a lower and out-of-the-money (OTM) strike price (

Strike Price:

- Expiration date: Same

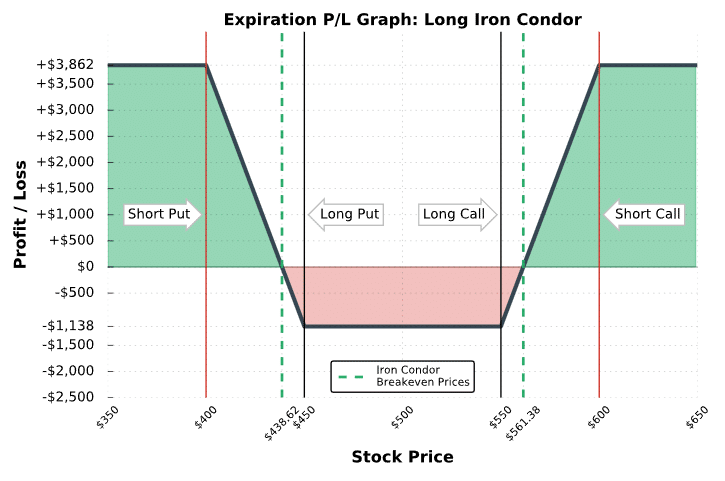

Long Iron Condor

Options:

- Sell a put option at a lower strike price (

Put 1). - Buy a put option at a higher strike price (

Put 2). - Buy a call option at a lower strike price (

Call 1). - Sell a call option at a higher strike price (

Call 2).

- Sell a put option at a lower strike price (

Strike Price:

- Expiration date: Same

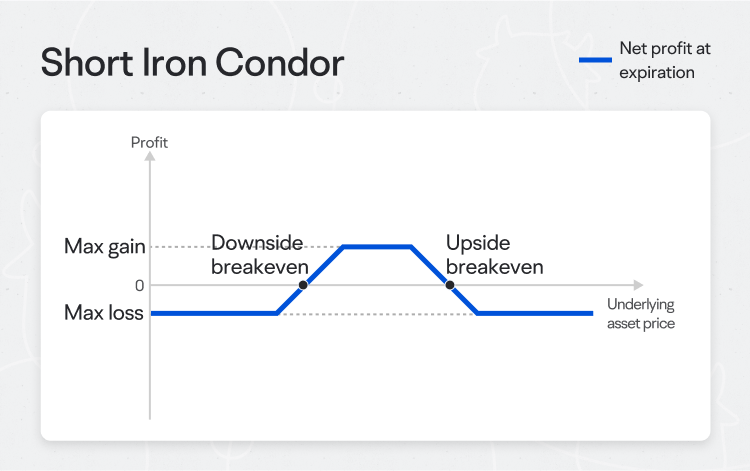

Short Iron Condor

- Options:

- Sell a put option at a lower strike price (

Put 2). - Buy a put option at an even lower strike price (

Put 1). - Sell a call option at a higher strike price (

Call 1). - Buy a call option at an even higher strike price (

Call 2).

- Sell a put option at a lower strike price (

- Strike Price:

- Expiration date: Same

- Maximum Profit:

- Maximun Loss:

- Market Outlook:

Traders expect the underlying asset will remain within the price range betweenPut 2 StrikeandCall 1 Strikeuntil expiration.

.PNG)

.PNG)

.PNG)