Appearance

What does RTGS/CHATS mean in Hong Kong (特快转账)

What is RTGS/CHATS system

RTGS(Real Time Gross Settlement,即时支付结算系统) is a payment system that allows for the continuous, real-time settlement of trasactions on a gross basis, meaning each transaction is settled individually without netting.

In Hong Kong, the RTGS system is specifically known as CHATS(Clearing House Automated Transfer System, 结算所自动转账系统).

RTGS/CHATS system supports multiple currencies, including the Hong Kong Dollor(HKD), renminbi(RMB), euro and US dollor.

The Hong Kong dollor Real Time Gross Settlement(RTGS) system (also known as Hong Kong dollor Clearing House Automated Transfer System(CHATS)) was introduced in 1996. With this system, Interbank payments denominated in the Hong Kong dollar are settled continously on a deal-by-deal basis across the book the HKMA without netting.

The US dollar RTGS system (also known as US dollar CHATS) was launched in August 2000 with The Kongkong and Shanghai Banking Corporation as its settlement institution.

The euro RTGS system (aslo known as Euro CHATS) was launched in Aprial 2003 with the Standard Chartered Bank (Hong Kong) Limited as its settlement institution.

The renminbi RGTG System (also known a renminbi CHATS) was upgraded from the Renminbi Settlement System in June 2007 with the Bank of China (Kong Kong) Limited as its clearing Bank.

What is avaibale time of RTGS/CHATS remittance

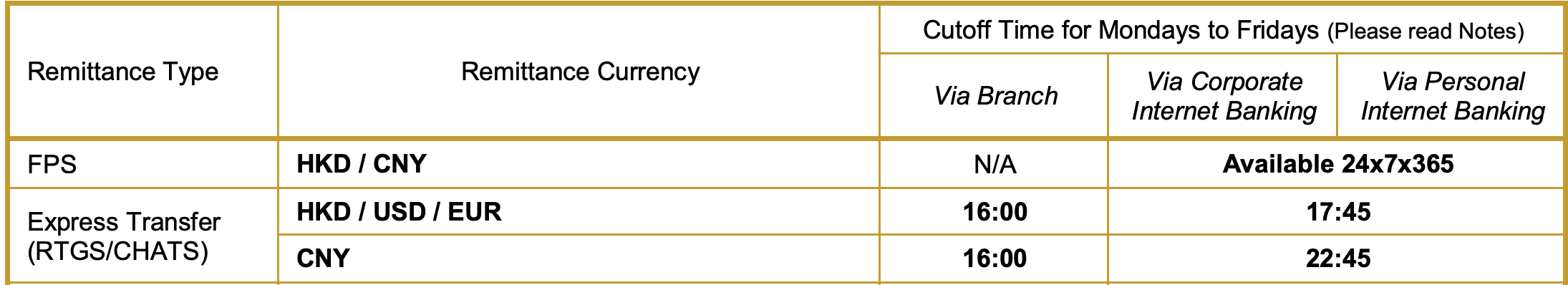

Unlike FPS, which is available 7x24, RTGS/CHATS remittance application only be processed on business days of Hong Kong. It means:

- Avaiable days: From Mondays to Fridays(excluding Public Holidays)

- Cutoff Time: 16:00 via Branch and 17:45 Via Internet Banking.

The remittance application submitted outside of these hours will be processed on next business day.

RTGS/CHATS remittance fees

- BOCHK Local Bank Transfer Charge The charges are waived in most of cases.

- (Effective 1 Nov 2024) Bank Tariff guide for HSBC Wealth and Personal Banking Customers [PDF] The charges are waived Via HSBC Online Banking / HSBC Mobile Banking.