Appearance

U.S. Dollar Index(USDX/DXY)

What is the U.S. Dollar Index

The U.S. Dollar Index is a geometrically-averaged calculation of six currencies weighted against the U.S. dollar.

The U.S. Dollar Index originally was developed by the U.S. Federal Reserve in 1973 to provide an external bilateral trade-weighted average value of the U.S. dollar as it freely floated against global currencies.

Since the inception of futures trading on the U.S. Dollar Index in 1985, ICE Futures U.S. compiles, maintains, determines and weights the components of the U.S. Dollar Index and causes it to be calculated and disseminated.

Which currencies are included in the U.S. Dollar Index?

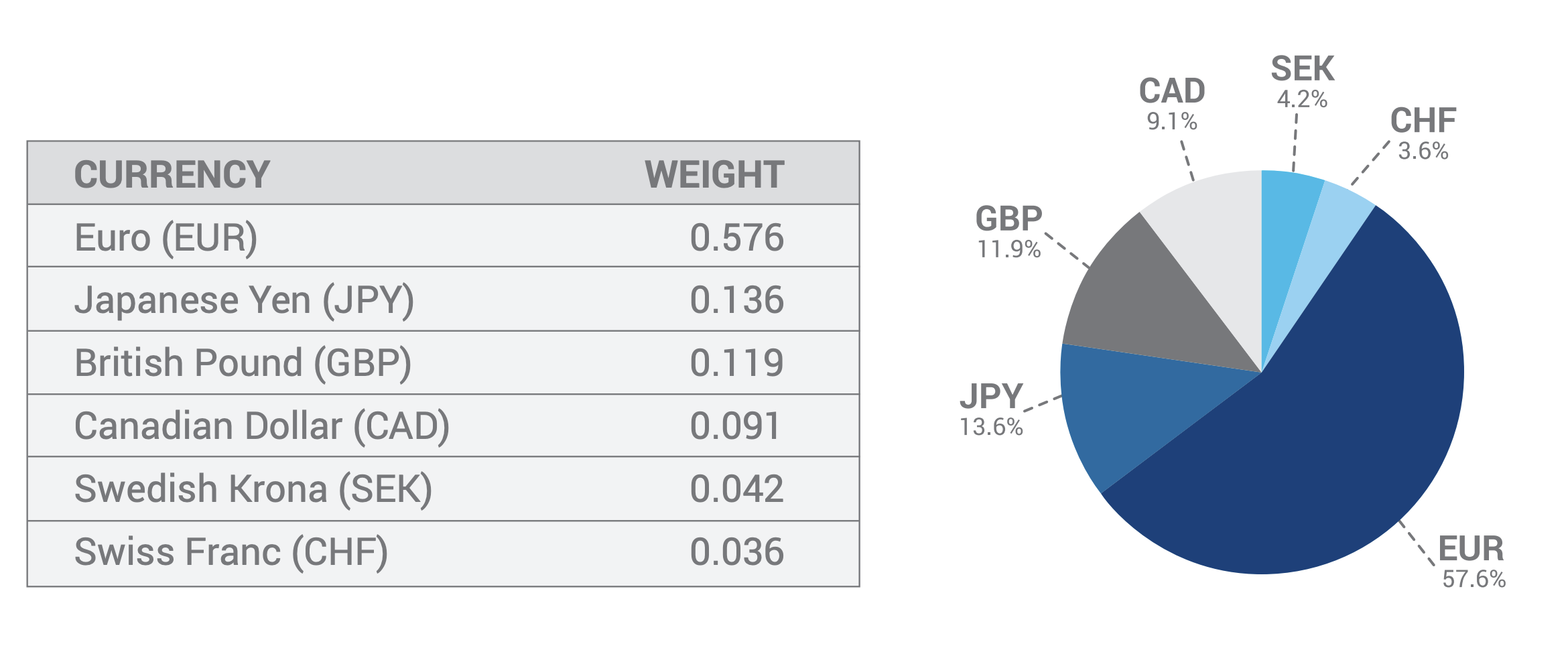

The U.S. Dollar Index contains six component currencies: the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc.

The U.S. Dollar Index is calculated with this formula:

USDX = 50.14348112 × EURUSD^-0.576 × USDJPY^0.136 × GBPUSD^-0.119 × USDCAD^0.091 × USDSEK^0.042 × USDCHF^0.036

when the U.S. dollar is the base currency, the value is positive; and when the U.S. dollar is the quote currency, the value is negative.

信息

The base currency is the first currency in a currency pair.

The value of the base currency is expressed in terms of the quote currency.

If the EUR/USD exchange rate is 1.2000, it means that 1 Euro (EUR) is equal to 1.20 U.S. Dollars (USD).

The above value is compared against the U.S. dollar relative to March 1973, when the world’s major trading nations allowed their currencies to float freely against each other.

How is the U.S. Dollar Index calculated?

The ICE U.S. Dollar Index is calculated in real time approximately every 15 seconds from a multi-contributor feed of the spot prices of the Index’s component currencies.

The price used for the calculation of the Index is the mid-point between the top of the book bid/offer in the component currencies. This real-time calculation is redistributed to all data vendors.

The prices of the DX futures contracts are set by the market, and reflect interest rate differentials between the respective currencies and the U.S. dollar.

When did the ICE U.S. Dollar Index become available for exchange trading?

Futures contracts based on the U.S. Dollar Index were listed on November 20, 1985.

Options on the futures contracts began trading September 3, 1986.

U.S. Dollar Index futures and options on futures are available exclusively on the ICE electronic trading platform.

What is the contract symbol for the U.S. Dollar Index?

The Exchange symbol for the futures contract is DX, followed by the month and year code.

The Exchange symbol for the value of the underlying Dollar Index (sometimes called the cash or spot index) is also DX (without a month or year code), although different data providers may use different symbols.

One of the popular symbols is Bloomberg’s DXY, so that the index is sometimes referred to as the “Dixie.”

ICE U.S. Dollar Index contracts trading hours

U.S. Dollar Index contracts trade electronically on the ICE electronic trading platform from 8:00 pm through 5:00 pm. ET the next day Monday through Thursday.Trading ends at 5:00 p.m. ET on Friday afternoon.

On Sunday evening, trading in the contracts begins at 6:00 p.m. ET; the trading session that begins on Sunday evening ends at 5:00 p.m. ET on the following Monday evening.

The ICE trading platform is available for order entry thirty minutes before the opening of trading.