Appearance

AXA 安盛

上市代码:

| Stock Exchanges | Ticker symbol |

|---|---|

| Euronext Paris exchange | CS.PAR on Financial Times CS.PA on Yahoo Finance CS.SBF on IB (Market Cap: €85.605B by 2025.3.7) |

| OTCQX | AXAHY (Market Cap: $94.687B by 2025.3.7) |

Proportion of the AXA share in the main indices

Indices | weight | Note |

|---|---|---|

| CAC 40 | 3.54 | The CAC 40 index is the main benchmark for Euronext Paris. Tracking a sample of Blue Chip stocks, its performance is closely correlated to that of the market as a whole. The index contains 40 stocks selected among the top 100 market capitalisation and the most active stocks listed on Euronext Paris, and is the underlying asset for options and futures contracts. The base value is 1,000 at December 31, 1987. |

| EURO STOXX 50 | 1.78 | The EURO STOXX 50 Index is a free-float capitalization-weighted index of 50 European blue-chip stocks from those countries participating in the EMU. Each component's weight is capped at 10% of the index's total free float market capitalization. The index was developed with a base value of 1000 as of December 31, 1991. This index uses float shares. FEZ |

| STOXX Europe 600 | 0.52 | The STOXX Europe 600 Index is a broad based capitalization-weighted index of European stocks designed to provide a broad yet liquid representation of companies in the European region. The equities use free float shares in the index calculation. The index was developed with a base value of 100 as of December 31, 1991. This index uses float shares. |

| STOXX Europe 600 Insurance | 10.22 | The STOXX Europe 600 Insurance Index is a capitalization-weighted index which includes European companies that are involved in the insurance sector. The index was developed with a base value of 100 as of December 31, 1991. |

| MSCI Euro Index | 1.30 | The MSCI Euro Index is a subset of the broader MSCI EMU Index. It was created to serve as the basis for derivative contracts, exchange traded funds and other passive investment products. The index comprises large and liquid securities with the goal of capturing 90% of the capitalization of the broader benchmark. It was developed with a base value of 1000 as of December 31, 1998. |

| MSCI Pan Euro Index | 0.63 | The MSCI Pan Euro Index is a subset of the broader MSCI Europe Index. It was created to serve as the basis for derivative contracts, exchange traded funds and other passive investment products. The index comprises large and liquid securities with the goal of capturing 90% of the capitalization of the broader benchmark. It was developed with a base value of 1000 as of December 31, 1998. |

| SBF120 | 2.87 | The SBF 120 Index is a capitalization-weighted index of the 120 most highly capitalized and most liquid French stocks traded on the Paris Bourse. The index uses free float shares and was developed with a base value of 1,000 as of December 28, 1990. |

| FTSE Developed Europe All Cap Index | 0.52 | The FTSE Developed Europe All Cap Index is a market-capitalization weighted index representing the performance of large, mid and small cap companies in Developed European markets, including the UK. The index is derived from the FTSE Global Equity Index Series (GEIS), which covers over 7,400 securities in 47 different countries and captures 98% of the world's investable market capitalization. VGK |

Articles

While owning asset management capabilities can be a boon for life insurers in particular, which need to source assets for their long-term liabilities, they can be expensive and expose their owners to the volatility of capital markets.

"It's difficult for an insurer to run an asset manager is the bottom line," Berenberg analyst Michael Huttner said in an interview.

Financial risks made up about 85% of Axa's portfolio in 2008 and would be 15% after the Axa Investment Managers (Axa IM) sale closes, the CEO said.

The European multiline insurance market is split on owning asset managers. Zurich Insurance Group AG sold its US asset manager Scudder in 2002 and offloaded its UK asset manager Threadneedle a year later. Allianz SE, Assicurazioni Generali SpA and Aviva PLC still own asset managers. In the Netherlands, NN Group NV sold its asset manager in 2022, but ASR Nederland NV is "very happy" with its own, Huttner said.

asset managers have high fixed-cost bases but lower capital requirement compared with insurance.

"Building on this, our new “Unlock the Future plan will be focused on growing and strengthening our core businesses, with rigorous execution. We aim at scaling organic growth, as well as technical and operational excellence across all our businesses, leveraging clear and proven initiatives across P&C Commercial lines, Employee Benefits and Individual Health, and Retail insurance,"

介绍

「AXA安盛業務概況及投資策略」電子小冊子

- 2024年4月 安省保险(百慕大)有限公司已完成对信利再保险(中国)有限公司100%股权的收购,进一步加强在中国大陆地区的业务发展。

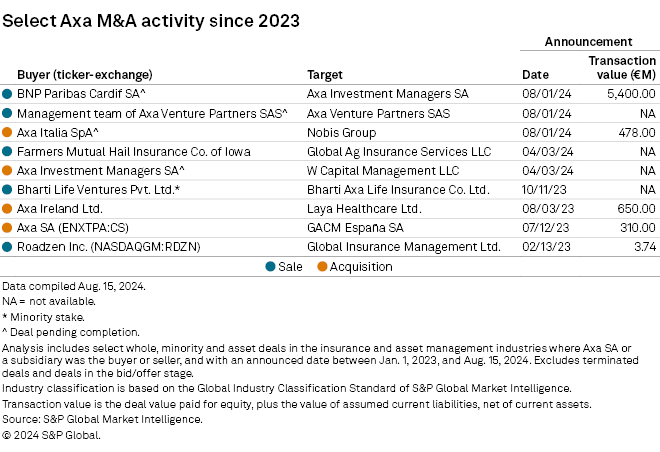

- 2024年 Signing of a Share Purchase Agreement with BNP Paribas for the sale of AXA Investment Managers.

- 2024年 Acquisition of Nobis Group (Italy), a predominantly Retail P&C insurance company (pending regulatory approval).

- 2024年 Announcement that AXA Life Europe has entered into a reinsurance agreement for an in-force Savings portfolio.

- 2023年11月 AXA安盛集团以6.5亿欧元完成对爱尔兰第二大医疗保险公司Laya Healthcare Limited的收购,在爱尔兰提供多元化及创新的医疗保险、人寿保险和旅行保险服务。

- 2023年 Acquisition of Laya Healthcare Limited (“Laya”)

- 2022年 Receipt by AXA SA of regulatory approval from the Autorité de contrôle prudentiel et de résolution (“ACPR”) to operate as a licensed reinsurer

- 2019年 Sale of AXA's remaining stake in Equitable Holdings, Inc. (EQH)

- 2019年 Acuisition of the remaining 50% stake in AXA Tianping.

- 2018年 Acquisition of the XL Group, creating the #1 global P&C Commercial lines insurance platform

- 2018年 IPO of Equitable Holdings, Inc., on the New York Stock Exchange.

- 2014年 Acquisition of 50% of TianPing, a Chinese Property & Casualty insurance company.

- 2014年 Acquisition of 51% of Grupo Mercantil Colpatria's insurance operations in Colombia

- 2014年 Acquisition of 77% of Mansard Insurance plc in Nigeria.

- 2013年 被列入九大全球系统重要性保险公司之一,被视为「大而不能倒」的金融结构

- 2012年 Launch of ICBC-AXA Life, a Life insurance joint venture in China with ICBC

- 2012年 Acquisition of HSBC's Property & Casualty operations in Hong Hong and Singapore.

- 2011年 国卫保险正式更名为安盛金融

- 2010年 Voluntary delisting of AXA SA from the New York Stock Exchange

- 2009年 被Interbrand评为全球第一大保险品牌,并连续10年夺冠。

- 2008年 Acquisition of Seguros ING (Mexico)

- 2006年 Acquisition of Winterthur group (Switzerland)

- 2005年 FINAXA (AXA's principal shareholder at that time) merged into AXA.

- 2004年 Acquisition of the American insurance group MONY

- 2000年 Acquisition of Sandford C. Bernstein(United States) by AXA's asset management subsidiary Alliance Capital, which subsequently changed its name to AllianceBernstein (now AB)

- 2000年 Acquisition of a minority interest in AXA Financial

- 1999年 香港上市公司私有化退市

- 1999年 国卫保险亚洲正式更名为安盛亚太区控股(AXA Asia Pacific Holdings Ltd)

- 1997年 Merger with Compagnie UAP

- 1995年 进军亚洲市场,在香港成立子公司

- 1992年 安盛于香港联交所上市

- 1992年 Acquisition of a controlling interest in The Equitable Companies Incorporated (United States), which subsequently changed its name to AXA Financial, Inc.("AXA Financial")

- 1991年 安盛以通过收购收购美国最主要的人寿保险公司之一Equitable公司,正式登录美国市场

- 1988年 Transfer of the insurance businesses to Compagnie du Midi (which subsequently changed its name to AXA Midi and then AXA)

- 1986年 收购香港国卫保险并成立国卫保险亚洲,主要负责发展亚洲地区的保险业务

- 1985年 正式给公司更名AXA,以便让所有语言都可以更方便的读写公司名称。

- 1982年 Takeover of Groupe Drouot

- 1968年 于贝尔贝夫落成新总部,大大提升了企业形象,成功摆脱“小型保险互助会”的历史

- 1946年 通过吸收合并小型地区互助保险商来壮大自己的实力

- 1944年 战乱下的公司举步维艰,战后法国社会保障体系的建立,通过为工人提供工伤和疾病保险,更是剥夺了互助保险商的大部分业务

- 1922年 安盛开始从事汽车保险业务,这一决定让公司利润短时间内飙升

- 1085年 发布全球统一品牌名称「AXA」

- 1881年 Mutualité Immobilière和Mutualié Mobilière合并,中文译作法国安盛

- 1817年 安盛集团的前身成立于法国,专门从事财产和意外伤害保险

欧洲第1大,全球第5大 资产管理人;

全球第二大总部设于欧洲的保险公司;

51个市场。

业务范围

Investor Releationships

2024

- Press release

- Presentation to analysts and investors

- Annual report

- Activity report

- Financial supplement IFRS17/9 (Excel)

- Press Presentation

- Interview transcript Thomas Buberl

2023

- Press release

- Presentation to analysts and investors

- Annual report

- Activity report

- Financial supplement IFRS17/9 (Excel)

- Press Presentation

- Press presentation (transcript)

- Interview transcript Thomas Buberl

2022

- Press release

- Presentation to analysts and investors

- Analysts and investors Presentation Transcript

- Annual report

- Activity report

- Financial supplement IFRS17/9 (Excel)

- Press Presentation

- Press presentation (transcript)

- Interview transcript Thomas Buberl

2021

- Press release

- Presentation to analysts and investors

- Analysts and investors Presentation Transcript

- Annual report

- Activity report

- Financial supplement IFRS17/9 (Excel)

- Press Presentation

- Interview transcript Thomas Buberl

2020

- Press release

- Presentation to analysts and investors

- Analysts and investors Presentation Transcript

- Annual report

- Activity report

- Financial supplement IFRS17/9 (Excel)

- Press Presentation

- Press presentation (transcript)

- Interview transcript Thomas Buberl