Appearance

Private Equity and Life Insurers

2023-12 International Monetary Fund - Private Equity and Life Insurers

The long period of extraordinarily low interest rates after the global financial crisis pushed life insurers to change their business models. Many large insurance groups are altering their business strategies to pivot away from capital-intensive business lines toward capital-light business such as unitlinked products, which leave much of the investment risk with policyholders.

Private equity (PE) companies seized the opportunity to acquire and gain exposure to the longterm, capital-intensive liabilities on life insurers’ balance sheets that the latter are trying to exit.

KKR’s acquisition of 60 percent of Global Atlantic (a US life insurer) in 2020 cost KKR approximately $3 billion. In KKR’s Earnings Conference Call in February 2021, participants estimated that this transaction increased its fee-paying AUM by 48 percent, and it is expected to increase fee income by $200 million per year or more (KKR & Co. Inc. 2021). Presumably, this will occur through Global Atlantic allocating some of its investment portfolio to KKR managed assets.

The relationship with life insurers and PE is now much more complex, with a range of strategies employed by different PE companies:

- PE companies own a small strategic stake in a life insurer (often less than 10 percent) and provide specialist investment management services through managing their structured credit, private credit, private real estate, and private equity investments. These arrangements are sometimes described as strategic alliances.

- Life insurers are purchased and owned by LBO schemes arranged by PE funds—the traditional business model of PE companies.

- Full or majority ownership of life insurers held by PE companies on their balance sheets which are strategically important to the other activities of the PE companies.

- Life insurers are heavily using offshore life reinsurers owned by PE companies to reinsure life insurance portfolios and to strategically restructure their businesses.

Life insurers are also independently engaging the services of PE-influenced reinsurers for strategic realignment of their businesses. Other life insurers also engage the services of PE companies to de-risk their balance sheets through reinsurance transactions and to manage portions of their own portfolios to earn the illiquidity premiums on investments.

An example of the trend of unrelated life insurers engaging the services of PE-influenced reinsurers for strategic realignment of their business can be found in the transaction announced on May 2, 2023, between Lincoln Financial Group (Lincoln) and Fortitude Reinsurance Ltd.

This transaction is a $28 billion transaction (Lincoln Financial Group 2023) comprising approximately $9 billion of universal life with secondary guarantees statutory reserves (approximately 40 percent of Lincoln’s total in-force universal life with secondary guarantees), close to $12 billion of universal life with long-term care rider statutory reserves (approximately 80 percent of Lincoln’s total in-force universal life with long-term care rider) and close to $8 billion of fixed annuities statutory reserves (approximately 40 percent of Lincoln’s total in-force fixed annuities).

Lincoln’s president and CEO Ellen Cooper provided the rationale for the transaction from Lincoln’s perspective: “Today’s transaction with Fortitude Re marks significant progress in our efforts to reduce our balance sheet risk, improve our capital position, and increase ongoing free cash flow.” Lincoln will service and administer the policies it reinsured to Fortitude Re, so customers will see no change.

PE companies are also benefiting from fee income. Fee income can be substantial, with average annual management fees estimated to be 1.76 percent and performance fees averaging 20.3 percent in 2018 and 2019 (DeLuce and Keliuotis 2020).

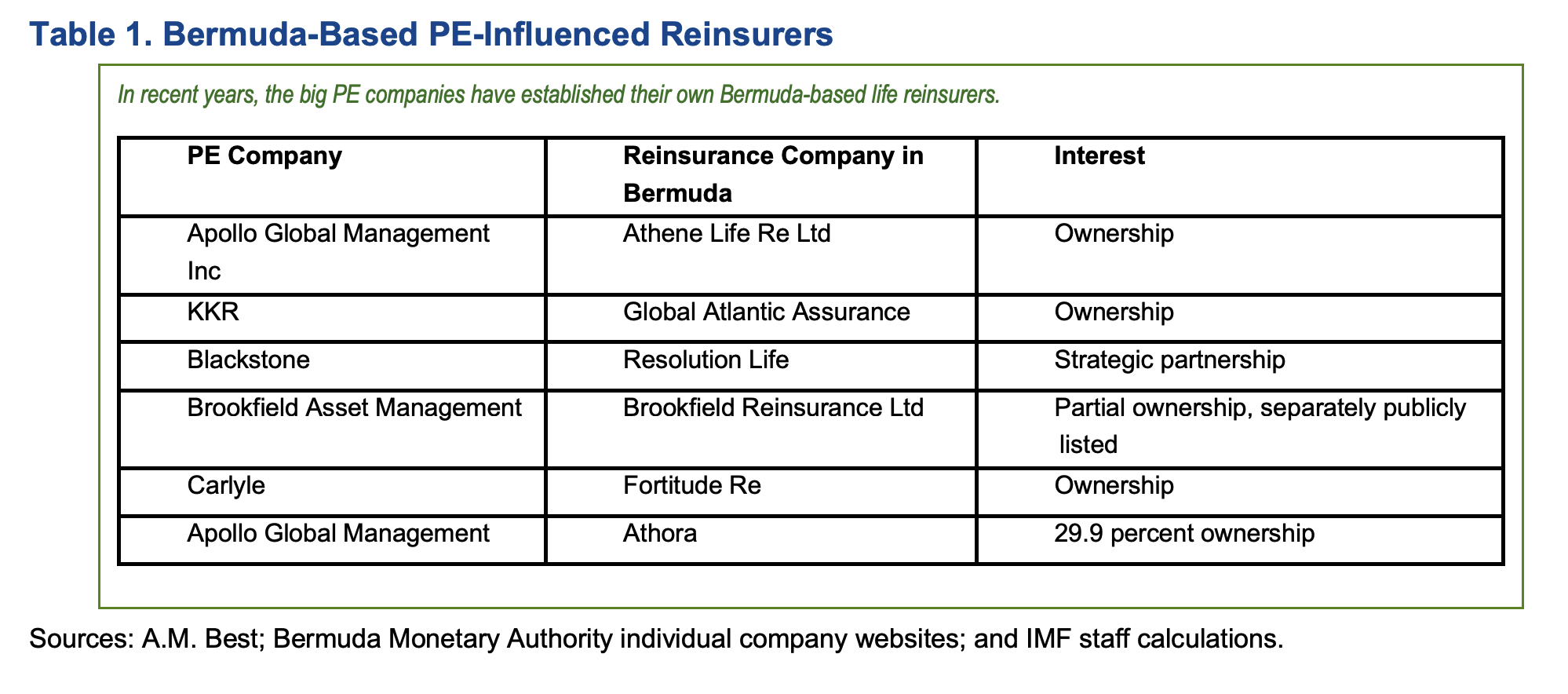

In recent years, the large PE companies have established their own offshore-based reinsurers, primarily in Bermuda. They have bought or reinsured blocks of life insurance or annuity business from life insurers and have even purchased life and annuity companies through their Bermuda reinsurers. This allows them to issue insurance products, reinsure them, and manage the premiums—limiting the ability of on-shore regulators to monitor these activities (Pechter 2021).

For Bermuda-based reinsurers, since January 2023, the Bermuda Monetary Authority (BMA) requires approval of life reinsurance transactions before execution, and in this process requires a comprehensive set of information, which it discusses with the regulator of the cedant and approves transactions only with the nonobjection of the regulator of the cedant.

In Europe and the United States, traditional life insurers, particularly publicly listed life insurers, have retreated from traditional products that help consumers have protection against their investment risk and longevity risk.

The PE companies help these traditional life insurers with their strategic pivot to capital light products by purchasing books of business and taking over life insurers in entirety.

Thoughts on Apollo's Insurance-Fueled Debt Growth? How Do Blackstone and KKR Compare?

Basically, Apollo is using insurance assets from Athene (which they've fully integrated) to drive debt growth. They're creating a cycle where insurance liabilities fund new debt platforms, which then feed assets back into their insurance balance sheet—a financial "ouroboros" if you will.

Would like to ask you PE folks:

Sustainability: Do you guys think this insurance-driven debt growth is sustainable long-term? Could it lead to lower returns or unexpected risks?

Comparisons: How does Apollo's approach measure up against firms like Blackstone or KKR? Are they using similar strategies, or do they have better business models without leaning so much on insurance assets?

There is some confusion in the question formulation and some other answers. What they are doing is investing insurance capital in private debt securities. Ie they are a lender, not a borrower. The major “innovation” is that instead of buying treasuries and highly rated bonds, they actively deploy the capital and end up with a diversified portfolio - a higher yielding asset pool, which supports higher profit margins within the insurance business. There is an arbitrage between regulatory capital between insurance companies and banks, hence making insurance companies more competitive on the lending side. It is sustainable, as long as they don’t screw it up and blow up the portfolio as to impair their ability to pay out claims.

How private equity will mould the region’s life insurance market

In a recent Guy Carpenter insight report, it unveiled that by 31 December 31 2023, Asia saw $25b in private equity-backed reinsurance transactions, just 2% of the total addressable assets.

“However, the value of deals rose tenfold between 2019 and 2023, led by recent transactions between insurers such as AXA HK, Manulife, FWD, T&D, Daiichi and Japan Post and reinsurers such as KKR-backed Global Atlantic, Apollo-backed Athene, Blackstone-backed Resolution, Carlyle-backed Fortitude and Reinsurance Group of America (RGA),” the Guy Carpenter report said.

Regulatory reforms across the region, including in Australia, China, South Korea, Hong Kong, and Singapore, and upcoming changes in Japan and Taiwan, prompt insurers to de-risk and free up capital for solvency or reinvestment in digitalization and profitable products.

Private equity-backed reinsurers are monitored by Asian regulators and are mostly domiciled in Bermuda, which has Solvency II equivalence from the European Commission.

Bermuda's regulatory regime is on par with the US and Canada, and its authority continues to tighten supervision.

KKR, Apollo Tap $5.8 Trillion in Japan Life Insurance for Assets

Companies controlled by KKR & Co., Apollo Global Management Inc. and other giant investors are doing deals to manage billions of dollars backing life and annuity policies. In an arrangement known as reinsurance, the Japanese insurers are reducing their risk by transferring some of their liabilities for future benefits to the money managers’ insurance units.

Japan, which has Asia’s second-largest economy and a population of more than 124 million, is one of the world’s biggest insurance markets, with about $5.8 trillion in individual life insurance and annuity policies in force at the end of 2023, according to the Life Insurance Association of Japan. KKR estimates that about $3 trillion of the market in Japan could be reinsured, but only about 1% of that amount currently is.