Appearance

Broadcom(AVGO)

Investor Relations

Investment Articles

San Francisco and Palo Alto—October 13, 2025—OpenAI and Broadcom today announced a collaboration for 10 gigawatts of custom AI accelerators.

OpenAI will design the accelerators and systems, which will be** developed and deployed in partnership with Broadcom**. By designing its own chips and systems, OpenAI can embed what it’s learned from developing frontier models and products directly into the hardware, unlocking new levels of capability and intelligence. The racks, scaled entirely with Ethernet and other connectivity solutions from Broadcom, will meet surging global demand for AI, with deployments across OpenAI’s facilities and partner data centers.

For Broadcom, this collaboration reinforces the importance of custom accelerators and the choice of Ethernet as the technology for scale-up and scale-out networking in AI datacenters.

OpenAI has grown to over 800 million weekly active users and strong adoption across global enterprises, small businesses, and developers. This collaboration will help OpenAI advance its mission to ensure that artificial general intelligence benefits all of humanity.

- 2025-09-08 Hyperscalers’ ASIC Outlook for 2026

Beyond OpenAI, Broadcom has confirmed ASIC orders from Google, Meta, and ByteDance, with Google's demand described as the largest.

Additional contracts are expected as projects advance, including ByteDance's second-generation ASIC, xAI's cloud-focused chip, and Apple's custom silicon. Production is slated for 2026 and 2027, with ByteDance likely leading in 2026, followed by xAI and Apple in 2027.

Google and Meta are developing successive ASIC generations scheduled for mass production between 2027 and 2028. ByteDance and OpenAI are also advancing next-generation designs, with rollout expected after 2028.

MediaTek has secured AI inference ASIC orders from Google and Meta, while competitors, including Marvell and Alchip, supply AWS, Microsoft, and Intel.

Industry insiders caution that while GPUs and ASICs overlap in some applications, the two markets will remain complementary. Nvidia and Broadcom are likely to dominate their respective domains, with fiercer rivalry expected in networking chips than in direct GPU–ASIC competition.

Hock Tan, the Broadcom CEO, is objectively a top 3 fabless semiconductor CEO, alongside Nvidia’s Jensen Huang and AMD’s Lisa Su.

There’s this notion that Broadcom acts like a strip-mining private equity roll-up operator that is constantly raising prices, cutting R&D, raising debt, to acquire more companies. This is undeserved FUD, but it causes many people to be reluctant of positivity towards Broadcom.

FUD(Fear, Uncertainty, and Doubt): 恐惧、不确定性和怀疑

It is a platform company focused on technology that acquires companies that sell market leading products with sticky customers, recurring revenue, and high margins but have excessive operating expenses and are generating below potential profit and cash flow.

Broadcom then cuts costs deeply, eviscerating layers of middle management, cutting sales and marketing functions down to those needed to directly support individual products, and almost completely eliminating general and administrative costs in favor of utilizing Broadcom’s existing corporate platform resources.

Research and development is a different story. Broadcom does eliminate science projects with unclear near-term return on investment as well as common research and development functions not directly driving revenues, but it leaves product teams intact. With layers of middle management cut out and a multitude of committees eliminated, product teams can obtain approval for plans directly from senior management and can execute them with greater alacrity. By loading overhead costs onto the product groups’ P&L and holding managers accountable for the group’s results, Broadcom has further driven a culture of efficiency and in many cases their market share has grown.

The perception of high debt loads is also another source of pushback, with the acquisition of VMWare taking Broadcom up to 2.9x debt/LTM Adjusted EBITDA. While Broadcom does load up debt when they acquire companies, we think the track record of growing free cash flow while deleveraging quickly post-acquisition AND paying shareholders considerable dividends while conducting buybacks mitigates this concern.

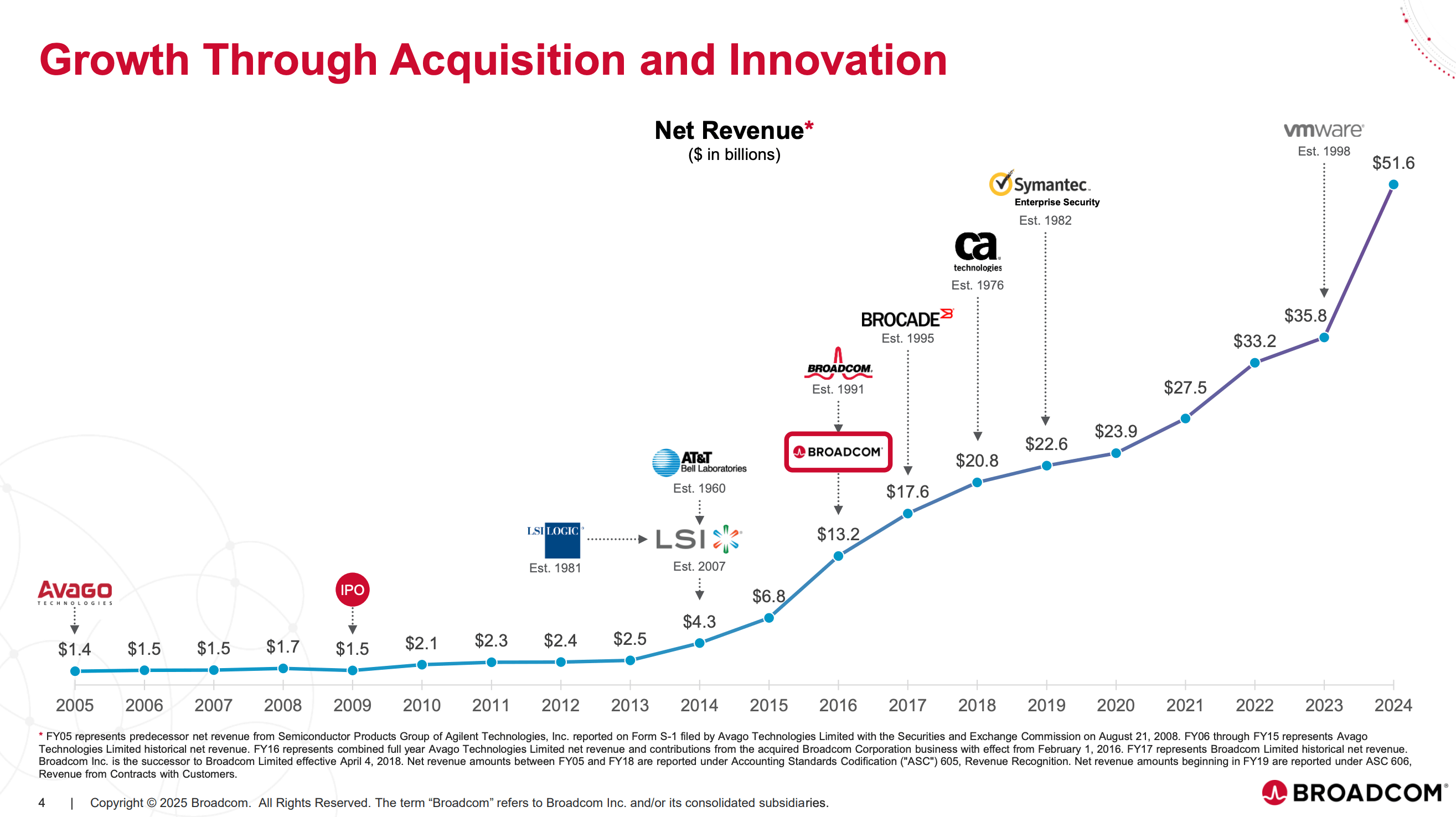

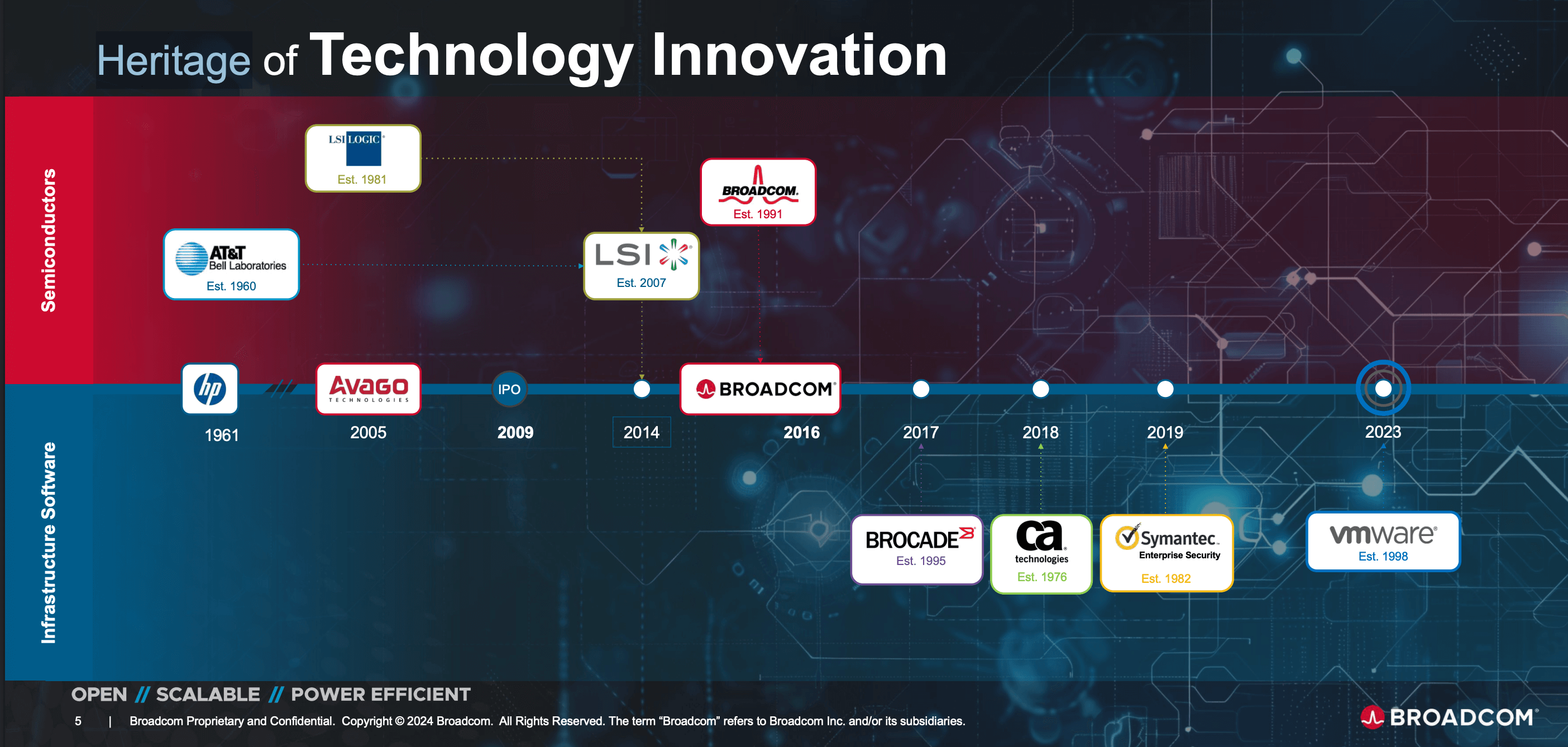

In 1999, HP decided to spin out businesses that were not tied to its core Enterprise Servers, Software, PC and Printers divisions. Agilent was spun out in 1999, containing HP’s test and measurement business. The semiconductor division within Agilent was further spun out in 2005 to a KKR and Silver Lake-led private equity consortium. By late 2005, the company was rebranded as Avago.

Hock Tan, our protagonist, took the helm as Avago’s CEO in 2006, setting the stage for the evolution of today’s Broadcom.

His first major move was in 2008 when he purchased Infineon’s Bulk Acoustic Wave (BAW) business for $30M, bringing the Film Bulk Acoustic Resonator (FBAR) Filter product into the fold – a deal that arguably ranks as one of the most profitable M&A transactions of all time.

In late 2013, Avago made its first major acquisition, purchasing LSI for its networking, storage and nascent custom silicon business.

Broadcom’s subsequent acquisition of Brocade Communications in 2016 solidified the storage segment by adding Brocade’s Fibre Channel and SAN directors to the segment.

One of Hock Tan’s biggest moves was Avago’s 2015 acquisition of Broadcom.

In 2018, just as investors and analysts were starting to see the fruits of Broadcom’s strategy and take a more constructive stance towards it, Broadcom shifted the landscape once again by acquiring CA Technologies, a company that focuses on Mainframe IT management and monitoring software and application development tools that essentially help manage, connect and coordinate disparate IT systems within an enterprise.

Broadcom followed up with its acquisition of Symantec’s Enterprise business in 2019. Symantec’s business focuses on Endpoint Protection, Secure Web Gateways and Data Loss Prevention.

SAN JOSE, Calif. and SINGAPORE, Dec. 16, 2013 (GLOBE NEWSWIRE) -- Avago Technologies Limited (Nasdaq:AVGO) and LSI Corporation (Nasdaq:LSI) today announced that they have entered into a definitive agreement under which Avago will acquire LSI for $11.15 per share in an all-cash transaction valued at $6.6 billion.

Quarterly Earnings Calls

2025Q4

- Broadcom Inc. Announces Fourth Quarter and Fiscal Year 2025 Financial Results and Quarterly Dividend

Based on increased cash flows in fiscal year 2025, we are increasing our quarterly common stock dividend by 10% to $0.65 per share for fiscal year 2026. The target fiscal year 2026 annual common stock dividend of $2.60 per share is a record, and the fifteenth consecutive increase in annual dividends since we initiated dividends in fiscal 2011.

We see the momentum continuing in Q1 and expect AI semiconductor revenue to double year-over-year to $8.2 billion, driven by custom AI accelerators and Ethernet AI switches.

In semiconductors, revenue was $11.1 billion as year on year growth accelerated to 35%. This robust growth was driven by AI semiconductor revenue of $6.5 billion, which was up 74% year on year.

Best exemplified at Google where the TPUs used in creating Gemini are also being used for AI cloud computing by Apple, Cohere, and SSI as a sample.

The scale at which we see this happening could be significant. As you are aware, last quarter, Q3 2025, we received a $10 billion order to sell the latest TPU ironwood racks to Anthropic. This was our fourth custom. That we mentioned. In this quarter Q4, we received an additional $11 billion order from this same customer for delivery in late 2026. But that does not mean our other two customers are using TPUs. In fact, they prefer to control their own destiny by continuing to drive their multiyear journey to create their own custom AI accelerators or XPU racks as we call them.

I am pleased today to report that during this quarter, we acquired a fifth XPU customer through a $1 billion order placed for delivery in late 2026.

Turning to non-AI semiconductors, Q4 revenue of $4.6 billion was up 2% year on year and up 16% sequentially based on favorable wireless seasonality. Year on year, broadband showed solid recovery. Wireless was flat.

All the other end markets were down as enterprise spending continued to show limited signs of recovery. Accordingly, in Q1, we forecast non-AI semiconductor revenue to be approximately $4.1 billion, flat from a year ago, down sequentially due to wireless seasonality.

Q4 Infrastructure Software revenue of $6.9 billion was up 19% year on year, both and above our outlook of 6.7. Bookings continued to be strong, as total contract value booked in Q4 exceeded $10.4 billion versus $8.2 billion a year ago. We ended the year with $73 billion of infrastructure software backlog, up from $49 billion a year ago.

We still expect, however, that for fiscal 2026, Infrastructure Software revenue to grow low double-digit percentage.

Directionally, we expect AI revenue to continue to accelerate and drive most of our growth. Non-AI semiconductor revenue to be stable. Infrastructure software revenue will continue to be driven by VMware growth at low double digits.

The weighted average coupon rate in years to maturity of our gross principal fixed rate debt of $67.1 billion is 4% and 7.2 years, respectively.

The board also approved an extension of our share repurchase program of which $7.5 billion remains, through the end of calendar year 2026.

For your modeling purposes, we expect Q1 consolidated gross margin to be down approximately 100 basis points sequentially, primarily reflecting a higher mix of AI revenue.

2025Q3

- Broadcom Inc. Announces Third Quarter Fiscal Year 2025 Financial Results and Quarterly Dividend

- FORM 8-K

2025Q2

- Broadcom Inc. Announces Second Quarter Fiscal Year 2025 Financial Results and Quarterly Dividend

- FORM 10-Q

2025Q1

2024Q4

- Broadcom Inc. Announces Fourth Quarter and Fiscal Year 2024 Financial Results and Quarterly Dividend

2024Q3

- Broadcom Inc. Announces Third Quarter Fiscal Year 2024 Financial Results and Quarterly Dividend

- Broadcom Inc. (AVGO) Q3 2024 Earnings Call Transcript

2024Q2

- Broadcom Inc. (AVGO) Q2 2024 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q1 2024 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q4 2023 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q3 2023 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q2 2023 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q1 2023 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q4 2022 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q3 2022 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q2 2022 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q1 2022 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q4 2021 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q3 2021 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q2 2021 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q1 2021 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q4 2020 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q3 2020 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q2 2020 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q1 2020 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q4 2019 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q3 2019 Earnings Call Transcript

- Broadcom Inc. (AVGO) Q2 2019 Earnings Call Transcript