Appearance

BERKSHIRE HATHAWAY

Home Page

Articles

2025-10-10 Thanksgiving Message from Warren Buffett

2023-02-27 Japanese Trading Companies (Part 2)

2023-02-11 Japanese Trading Companies (Part 1)

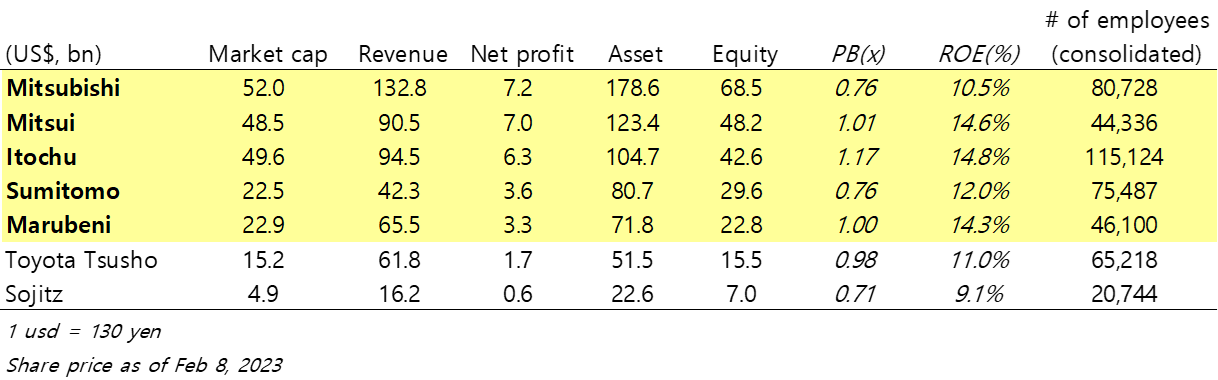

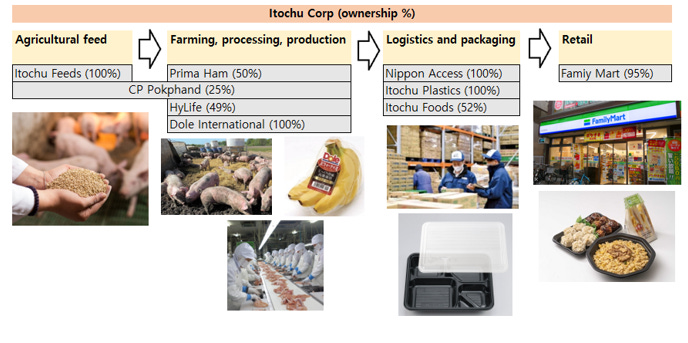

Sogo Shosha means “General (=Sogo) Trading Company (=Shosha)”. The name itself doesn’t carry a lot of meaning but today it specifically refers to seven large-caps: Mitsubishi, Mitsui, Itochu, Sumitomo, Marubeni, Toyota Tsusho, and Sojitz.

Shoshas are inflation-protected. They own substantial stakes in mining and energy interests globally, and also have stakes in places like agriculture and food where prices are going up. Their trading businesses earn a commission on total value of goods and is inflation protected.

“Perhaps Mr. Buffett wanted to have discussions or debates about other companies in Japan if there was some kind of opportunity. For foreign investors, trading companies are a gateway to Japan. Trading companies have business dealings with pretty much all industries and it’s a quick and efficient way to tap into the Japanese industry”

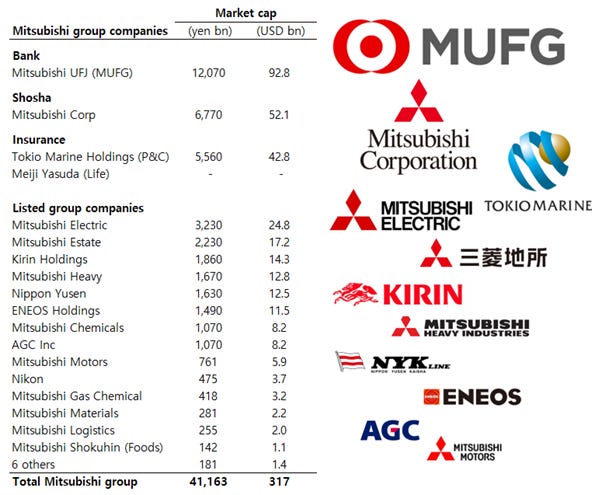

Let’s take a look at Mitsubishi, which is considered the most powerful and prolific Keiretsu. Take note that Mitsubishi Corp (the trading company) has the second largest market cap in the group, after the main bank MUFG. Another interesting point is that not all members carry the name Mitsubishi e.g. the beer company Kirin and the camera maker Nikon.

- 2020-08-31 Berkshire Hathaway acquires 5% passive stakes in each of five leading Japanese trading companies

At the opening of business today, Berkshire Hathaway’s wholly-owned subsidiary, National Indemnity Company, will notify Japan’s Kanto Local Finance Bureau that it has acquired slightly more than 5% of the outstanding shares in five of the leading Japanese trading companies.

The companies, listed alphabetically, are Itochu(伊藤忠商事,8001), Marubeni(丸红商事, 8002), Mitsubishi(三菱商事,8058), Mitsui(三井物产,8031) and Sumitomo(住友商事,8053). These holdings were acquired over a period of approximately twelve months through regular purchases on the Tokyo Stock Exchange.

Berkshire Hathaway’s intention is to hold its Japanese investments for the long term. Depending on price, Berkshire Hathaway may increase its holdings up to a maximum of 9.9% in any of the five investments. ... The company will make no purchases beyond that point unless given specific approval by the investee’s board of directors.

“I am delighted to have Berkshire Hathaway participate in the future of Japan and the five companies we have chosen for investment. The five major trading companies have many joint ventures throughout the world and are likely to have more of these partnerships. I hope that in the future there may be opportunities of mutual benefit.”

Berkshire Hathaway has 625.5 billion of yen-denominated bonds outstanding, maturing at various dates beginning in 2023 and ending in 2060. Consequently, the company has only minor exposure to yen/dollar movements.

I think it was quite a good transaction from AIG’s standpoint. Because they did take 20 billion of potential losses off for 10.2 billion.

I mean, when somebody hands you $10.2 billion and says, “I’m counting on you to pay 20 billion back, even if it’s 50 years from now, on the last dollar,” there are very few people that they’d want to hand 10.2 billion to. And there’s limited people on the other side.

American International Group, Inc. (NYSE: AIG) today announced that it has entered into a binding term sheet for an adverse development reinsurance agreement, effective January 1, 2016, with National Indemnity Company (NICO), a subsidiary of Berkshire Hathaway Inc. The agreement covers 80% of substantially all of AIG’s U.S. Commercial long-tail exposures for accident years 2015 and prior, which includes the largest part of AIG’s U.S. casualty exposures during that period. AIG will retain sole authority to handle and resolve claims, and NICO has various access, association and consultation rights.

The consideration for this agreement is $9.8 billion payable in full by June 30, 2017, with interest at 4% per annum from January 1, 2016 to date of payment. The consideration paid to NICO will be placed into a collateral trust account as security for NICO’s claim payment obligations to the AIG operating subsidiaries, and Berkshire Hathaway will provide a parental guarantee to secure the obligations of NICO under the agreement.

NICO is assuming 80% of the net losses and net allocated loss adjustment expenses on the subject reserves in excess of the first $25 billion and NICO’s overall limit of liability under the agreement is $20 billion. This provides material protection to policyholders against adverse developments beyond current reserve levels.

SEC Fillings

Our periodic operating results may be affected in future periods by the impacts of ongoing macroeconomic and geopolitical conflicts and events, as well as changes in industry or company-specific factors or events. The pace of changes in these events, including tensions from developing international trade policies and tariffs, accelerated through the first six months of 2025. Considerable uncertainty remains as to the ultimate outcome of these events. We are currently unable to reliably predict the ultimate impact on our businesses, whether through changes in the availability of products, supply chain costs and efficiency, and customer demand for our products and services. It is reasonably possible there could be adverse consequences on most, if not all, of our operating businesses, as well as on our investments in equity securities, which could significantly affect our future results.

Underwriting results in the first six months of 2025 included after-tax losses of approximately $850 million from the Southern California wildfires, which occurred in the first quarter.

Aftertax foreign currency exchange rate losses were $877 million in the second quarter and $1.6 billion in the first six months of 2025 compared to gains of $446 million and $1.0 billion in the corresponding 2024 periods.

After-tax corporate investment income increased $1.1 billion in the first six months of 2025 compared to 2024, primarily attributable to the impact of increased investments derived from subsidiary capital distributions to Berkshire.

We write primary insurance and reinsurance policies covering property and casualty risks, as well as life and health risks. Our insurance and reinsurance businesses are GEICO, Berkshire Hathaway Primary Group (“BH Primary”) and Berkshire Hathaway Reinsurance Group (“BHRG”).

We strive to generate pre-tax underwriting earnings (defined as premiums earned less insurance losses/benefits incurred and underwriting expenses) over the long term in all business categories, except in our retroactive reinsurance and periodic payment annuity businesses.

Time-value-of-money concepts are important considerations in establishing premiums for these policies, which are recognized as charges to earnings over the claim settlement periods.

GUARD’s premium declines reflected volume reductions across multiple product categories due to management’s decision to exit certain unprofitable lines and tightened overall underwriting standards beginning in 2024.

The increases at NICO Primary and BHHC were primarily attributable to commercial auto and property business, while the increases at BH Direct reflected growth across several lines of business and product categories.

Premium rates for new periodic payment annuity business continue to be at unacceptable levels. We have not written any new business since 2022.

BHE’s income tax benefit and net earnings include significant production tax credits primarily from wind-powered electricity generation.

On July 4, 2025, the One Big Beautiful Bill Act (the “OBBBA”) was enacted, introducing substantial revisions to federal energy-related tax policy. Among its provisions, the OBBBA accelerates the phase-out of clean electricity production and investment tax credits and establishes new sourcing requirements applicable to facilities commencing construction after December 31, 2025.

We are currently evaluating the potential implications of the OBBBA on BHE’s financial results and capital expenditures related to renewable energy, storage and technology neutral projects, including the potential impact on the economics and viability of such projects. These evaluations may be further affected by broader macroeconomic and geopolitical conditions, including changes in international trade policies and tariff regimes. Due to the inherent uncertainties involved, we are unable to estimate the impact on BHE’s energy business at this time.