Appearance

Novo Nordisk

News

When Novo Nordisk launched Wegovy(“诺和盈® 司美格鲁肽注射液”), its pioneering weight-loss jab, in America in June 2021, it felt like it was “running into a dark tunnel”, recalls Maziar Mike Doustdar, who took over as the Danish drugmaker’s chief executive in August. Although it knew the opportunity was vast, the company had little way of telling how big demand would be, or where it would come from. Novo, laments Mr Doustdar, suffered from the “curse of leadership”.

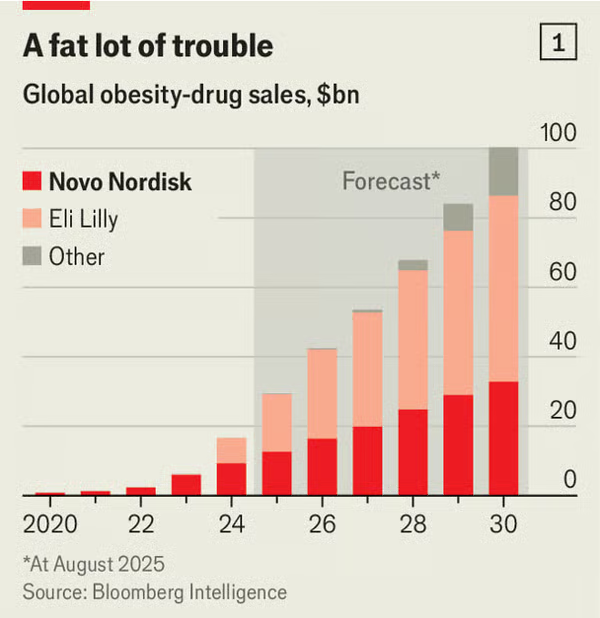

For more than two years it had the entirety of the market for weight-loss drugs to itself. By 2023 sales of Wegovy had reached $4.3bn in America. That year, however, Eli Lilly, a rival drugmaker which had closely watched Novo’s missteps, launched a weight-loss injection of its own, called Zepbound (替西帕肽 (Tirzepatide)). In 2024 it brought in sales of $4.9bn, three-quarters as much as Wegovy. This year it will pull ahead. By 2030 Lilly will control more than half of the global market for obesity drugs, compared with just a third for Novo, according to forecasts from Bloomberg Intelligence, a research group

Investors in the Danish drugmaker are rattled. Its market value, at around DKr1.4trn ($220bn), is down by two-thirds from its peak in June 2024, when it was Europe’s most valuable company. Lilly’s is up by more than a quarter since then. Even so, in an interview with The Economist, Mr Doustdar sounded confident that Novo can recover. His prescription is to push a new generation of obesity treatments while making sweeping changes to how the company operates.

Novo was well placed to lead the weight-loss revolution. Founded more than a century ago to make insulin, a hormone that regulates blood sugar, it is a specialist in metabolic diseases. The company’s headquarters in Bagsværd, just outside Copenhagen, centre on a spiral staircase modelled on the insulin molecule. Around a decade ago Novo’s scientists noticed that semaglutide(司美格鲁肽), a promising diabetes drug, also suppressed appetite, setting off the effort to create a new class of weight-loss treatments. (Semaglutide, which mimics the GLP-1 hormone, is the active ingredient in both Wegovy and Ozempic, a drug approved in America in 2017 for diabetes.)

Novo, however, vastly underestimated the appetite for its new weight-loss jab. Mr Doustdar says it planned for demand to be three times that of Saxenda(赛诺达), an older and less effective weight-loss drug. But five weeks after its launch in America, Wegovy had notched up the equivalent of four years’ worth of Saxenda prescriptions. Production could not keep pace. As a result, Wegovy was placed on America’s official shortage list, exposing it to “compounding” pharmacies, which are allowed to copy brand-name drugs when supply is insufficient and sell them at steep discounts. Although Wegovy was removed from the shortage list in February, loopholes mean that compound copycats are still available. Novo estimates that approximately 1m Americans use them.

Just as Novo’s supply was coming up short, Lilly launched Zepbound. In its own head-to-head trial, patients on Zepbound lost 20% of their body weight, compared with 14% on Wegovy. What is more, Lilly, which had observed the growth of Wegovy, began ramping up production well before it had gained approval for Zepbound. As a result, the drug has been readily available since October last year.

Lilly also realised early that selling weight-loss drugs is unlike peddling most other medicines. Demand has been propelled not by doctors and insurers, but by patients themselves, many of whom pay for the treatment directly. From early 2024 Lilly began bypassing intermediaries and going straight to patients. It offered low-dose Zepbound vials online for $399, well below the wholesale list price of about $1,100 (and cheaper even after the discounts insurers receive). It also teamed up with various telehealth providers to broaden its reach. Novo was late to adapt, launching its own direct offering a year after Lilly. It set up a partnership with Hims & Hers, a telehealth company, in April, but this quickly collapsed, partly because the provider kept selling Wegovy copycats.

Tough medicine

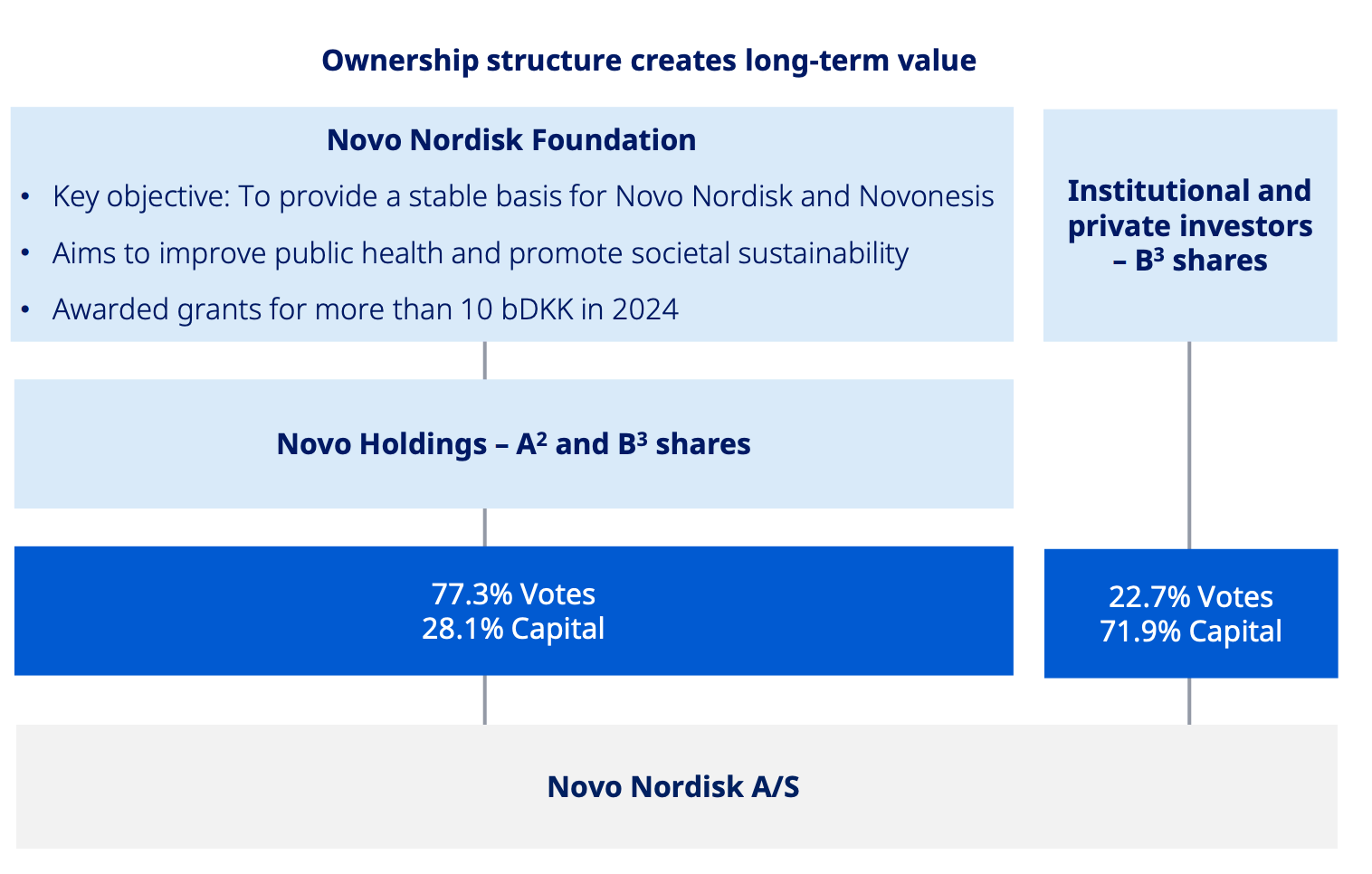

Novo was shaken out of its complacency in May, when the board booted out its chief executive since 2017, Lars Fruergaard Jorgensen. The changes to its leadership did not stop there, as the Novo Nordisk Foundation, which owns more than a quarter of the shares in the drugmaker, began to reassert itself. Its chairman, Lars Rebien Sorensen, who ran Novo before Mr Jorgensen, rebuked the board for being “too slow” to grasp the extent of the shift in the market for weight-loss drugs. Following a purge in October in which seven members of the board resigned, Mr Sorensen took over as the drugmaker’s chairman.

A person close to both Mr Sorensen and Mr Doustdar says they will be “ruthless” in doing “what it takes” to recover lost ground. Change is already under way. In September Novo cut 9,000 jobs, more than a tenth of its workforce, including about 5,000 in Denmark, the biggest lay-off ever in the country. Mr Doustdar points out that the restructuring was completed in under two months, brisk by Danish standards. He has also halted the development of any drug not tied to diabetes or obesity. With about 2bn people worldwide affected by one or the other, he says, Novo has plenty of room to grow.

That narrower focus is meant to clear the way for two new drug launches next year. One is an oral version of Wegovy that, in trials, produced better weight-loss results than Lilly’s competing pill. Some analysts worry that patients may balk at the requirement to take it on an empty stomach and wait half an hour before eating (Lilly’s pill carries no such strictures). But Martin Lange, Novo’s chief scientist, dismisses the concern, noting that diabetics are already taking oral semaglutide without fuss. The second launch is a higher-dose Wegovy injection that achieved weight loss comparable with Zepbound in trials. Novo hopes it will counter the perception that its treatment is less potent. The company adds that, this time around, it will have ample capacity in place for the drugs.

Novo is also making wider changes to how it does business. It wants to grow its direct channels, which currently account for a tenth of Wegovy prescriptions in America. To that end, it has struck deals with retailers including Costco and Walmart that will sell its drugs. Partnerships alone, however, will not be enough. Mr Doustdar says Novo must build a “consumer mindset”; he wants it to think “more like Amazon”, offering customers the speed and flexibility they experience when making other purchases.

Novo is revising its pricing, too. IIt recently began offering Wegovy to customers directly for $199 for the first two months, rising to $349 thereafter. (Lilly retaliated by cutting prices for Zepbound sold directly.) In November both firms also struck deals with the Trump administration to provide Medicare, the public insurer for the elderly, with discounted access to their obesity drugs, at roughly a third less than the price charged to commercial insurers. In return, Medicare agreed to cover the treatments for the first time.

The final shift in Novo’s strategy relates to how it will build its pipeline. The company has traditionally relied on its own labs rather than acquisitions, but that is changing.In November it entered a public bidding contest with Pfizer, an American drugmaker, for Metsera, a biotech firm with a promising obesity drug under development. Pfizer won, but Mr Doustdar is unbothered. Treating hundreds of millions of patients, he says, requires openness to outside ideas. He wants Novo to build a broad portfolio of obesity drugs so that it can offer each patient the treatment best suited to their needs.

Novo may well need outside help. Lilly has a formidable pipeline of its own, and has experience across a wider range of diseases, which may be an advantage as obesity drugs are increasingly used to treat adjacent conditions such as kidney and liver problems. Other competitors are also eyeing the weight-loss business. Over 160 new obesity drugs are currently in development. Moreover, semaglutide will lose patent protection next year in several big emerging markets—including Brazil, China and India—which will expose Novo to greater competition from generic drugs in those places, which are home to many of the world’s obese.

Still, Novo’s biggest battle may be internal, as it seeks to transform itself from a cautious drugmaker into a nimble consumer brand. Mr Doustdar is not out of the tunnel yet.

Novo Nordisk intends to reduce the global workforce by approximately 9,000 of the 78,400 positions in the company, with around 5,000 reductions expected in Denmark.

Over the past years, Novo Nordisk’s rapid scaling has increased organisational complexity and costs.

The workforce reduction is expected to deliver total annualised savings of around DKK 8 billion by the end of 2026.

The company-wide transformation comes with an expected DKK 8 billion in net one-off restructuring costs, including impairment charges. Restructuring costs of around DKK 9 billion will be incurred in the third quarter of 2025, countered by savings of around DKK 1 billion in the fourth quarter. Consequently, Novo Nordisk expects an estimated one-off negative impact of around 6 percentage points on full-year operating profit growth at CER in 2025 compared to the operating profit outlook issued 6 August.

Outlook 2025

- Expectations 6 August

- Operating profit growth (EBIT) at CER: 10-16%

- Depreciation, amortisation and impairment losses: Around DKK 17 billion

- Expectations 10 September:

- Operating profit growth (EBIT) at CER: 4-10%

- Depreciation, amortisation and impairment losses: Around DKK 21 billion

CER = Constant Exchange Rates

Aug. 18, 2025-- GoodRx (Nasdaq: GDRX), the leading platform for medication savings in the U.S., today announced that via a collaboration with Novo Nordisk, all strengths of Ozempic® (semaglutide) and Wegovy® (semaglutide) pens are available to eligible self-paying patients for $499-per-month through GoodRx, effective today.

Financial results

2025Q3

- Company announcement

- Download financial workbook (xlsx)

- Investor presentation (ipaper)

- Watch the Q1 2025 investor webcast

- London conference call webcast

2025Q2

Lars Fruergaard Jørgensen, president and CEO: "While delivering 18% sales growth in the first half of 2025, we have lowered our full-year outlook due to lower growth expectations for our GLP-1 treatments in the second half of 2025. As a result, we are taking measures to sharpen our commercial execution further, and ensure efficiencies in our cost base while continuing to invest in future growth. With more than one billion people living with obesity globally, including more than 100 million living in the US, and only a few million on treatment, I am confident that under Mike Doustdar's leadership, Novo Nordisk will maximise the significant growth opportunities, supported by a strong product portfolio and future pipeline".

- Download financial workbook (xlsx)

- Investor presentation

- Watch the Q2 2025 investor webcast

- Novo Nordisk Conference Call 2025-07-29