Appearance

Pfizer

Investor Relations

News

Pfizer anticipates full-year 2026 revenues to be in the range of $59.5 to $62.5 billion, while full-year 2025 revenue guidance(2) is revised to approximately $62.0 billion from the range of $61.0 to $64.0 billion previously.

Pfizer expects full-year 2026 operational(3) revenue growth at the midpoint, excluding both COVID-19 and LOE products, to be approximately 4% year-over-year.

Pfizer anticipates full-year 2026 Adjusted(1) diluted EPS to be in a range of $2.80 to $3.00.

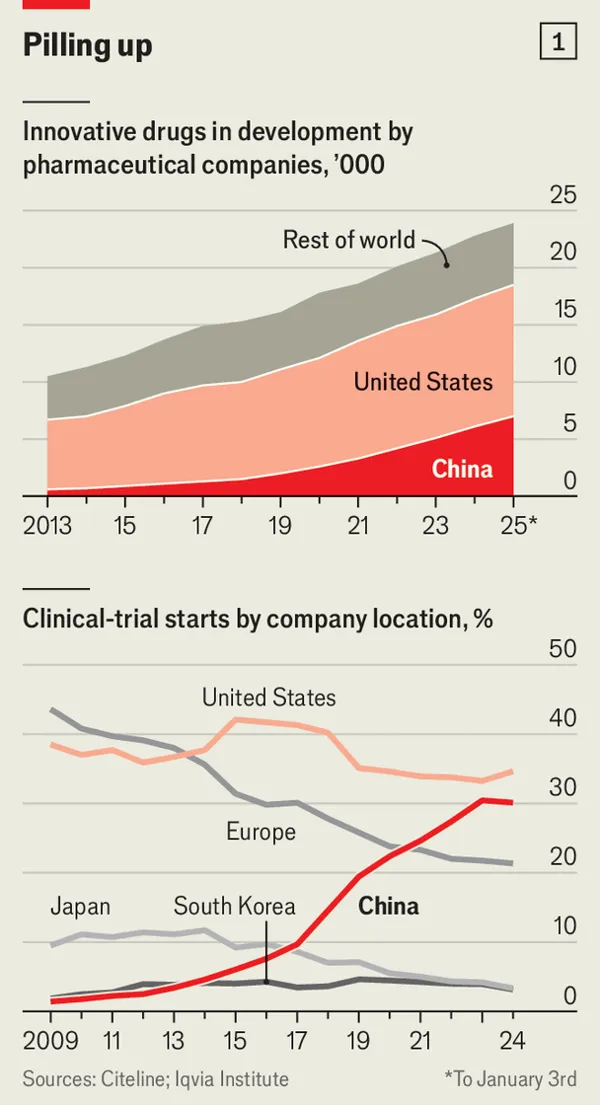

AFTER AMERICA, China is the world’s largest developer of new medicines and its companies ran about a third of the planet’s clinical trials last year. That is up from just 5% a decade before (see chart 1).

These companies face some of the steepest “patent cliffs” in their history, as drugs expected to generate more than $300bn in total revenue over the next six years will lose their patent protection by 2030.

In May Pfizer, America’s biggest drugmaker, agreed to pay $1.25bn in fees to 3SBio(1530.HK), a Chinese biotech firm, for the rights to manufacture and sell an experimental cancer drug outside China, if approved.

The following month GlaxoSmithKline, a British rival, struck a $500m deal with Hengrui(1276.HK), another Chinese company, for a lung-disease treatment and the options to buy 11 more drugs, that together may be valued at as much as $12bn, depending on certain milestones being met.

In November 2019 BeOne Medicines, a Chinese biotech firm formerly known as BeiGene(ONC), became the first local outfit to win approval from the Food and Drug Administration (FDA), America’s drug regulator, for a cancer drug.

Patents on semaglutide—the active ingredient in Wegovy and Ozempic, the wildly popular weight-loss treatments made by Novo Nordisk, a Danish pharma giant—are due to expire in China next year.

A growing model is the “NewCo”, under which a biotech company sets up a legally distinct company in America, often backed by foreign investors, and spins off promising assets into it.

In June it halted any new clinical trials that exported Americans’ genetic data to China. A report published in April 2025 by a congressional committee that included Eric Schmidt, Google’s former boss, warns that China’s strength in drug discovery, combined with its advances in artificial intelligence, could soon allow its firms to eclipse America’s. He and others fret about the security risks at the junction of pharmaceuticals and biotechnology.

NEW YORK, Nov. 7, 2025 /PRNewswire/ -- Metsera, Inc. (NASDAQ: MTSR) today announced that it has entered into an amended merger agreement with Pfizer, pursuant to which Pfizer will acquire Metsera for up to $86.25 per share, consisting of $65.60 per share in cash and a contingent value right (CVR) entitling holders to additional payments of up to $20.65 per share in cash.

47.50 > 86.25

Transaction valued at $47.50 per Metsera share in cash upon closing, for an initial enterprise value of $4.9 billion with a CVR of up to $22.50 per share in additional payments

Under the terms of the agreement, Pfizer will acquire all outstanding shares of Metsera common stock for $47.50 per share in cash at closing, representing an enterprise value of approximately $4.9 billion. Additionally, the agreement includes a non-transferable contingent value right (CVR) entitling holders to potential additional payments of up to $22.50 per share in cash tied to three specific clinical and regulatory milestones: $5 per share following the Phase 3 clinical trial start of Metsera’s MET-097i+MET-233i combination, $7 per share following U.S. Food and Drug Administration (FDA) approval of Metsera’s monthly MET-097i monotherapy, and $10.50 per share following FDA approval of Metsera’s monthly MET-097i+MET-233i combination, if achieved. The transaction is expected to close in the fourth quarter of 2025, subject to the satisfaction of customary closing conditions, including receipt of required regulatory approvals and approval by Metsera’s shareholders.

Quarterly Earnings

2025Q1

2024Q4

2024Q3

- Press Release

- Presentation

- Prepared Remarks

- SEC Filings

- Transcript

- Infographic

- Pfizer Inc. (PFE) Q3 2024 Earnings Call Transcript

2024Q2

- Press Release

- Presentation

- Prepared Remarks

- SEC Filings

- Transcript

- Infographic

- Pfizer Inc. (PFE) Q2 2024 Earnings Call Transcript

2024Q1

- Press Release

- Presentation

- Prepared Remarks

- SEC Filings

- Transcript

- Infographic

- Pfizer Inc. (PFE) Q1 2024 Earnings Call Transcript

2003Q4

- Press Release

- Presentation

- Prepared Remarks

- SEC Filings

- Transcript

- Infographic

- Pfizer Inc. (PFE) Q4 2023 Earnings Call Transcript

2003Q3

- Press Release

- Presentation

- Prepared Remarks

- SEC Filings

- Transcript

- Infographic

- Pfizer Inc. (PFE) Q3 2023 Earnings Call Transcript

2003Q2

- Press Release

- Presentation

- Prepared Remarks

- SEC Filings

- Transcript

- Infographic

- Pfizer Inc. (PFE) Q2 2023 Earnings Call Transcript

2003Q1

- Press Release

- Presentation

- Prepared Remarks

- SEC Filings

- Transcript

- Infographic

- Pfizer Inc. (PFE) Q1 2023 Earnings Call Transcript