Appearance

Visa

Visa Investor Relations

Class B-1, B-2 and C Common Stock Information

Series A, B and C Convertible Participating Preferred Stock Information

Common Stock Dividends

Defination

- Payments volume represents the aggregate dollar amount of purchases made with cards and other form factors carrying the Visa, Visa Electron, V PAY and Interlink brands and excludes Europe co-badged volume.

- Cash volume generally consists of cash access transactions, balance access transactions, balance transfers and convenience checks.

- Total volume is the sum of payments volume and cash volume.

- CEMEA: Central Europe, Middle East and Africa. Several European Union countries in Central Europe, Israel and Turkey are not included in CEMEA.

- LAC: Latin America. LAC is comprised of countries in Central and South America and the Caribbean

- International includes Asia Pacific, Canada, CEMEA, Europe and LAC.

Visa Debit is a major brand of debit card issued by Visa in many countries around the world. Numerous banks and financial institutions issue Visa Debit cards to their customers for access to their bank accounts. In many countries the Visa Debit functionality is often incorporated on the same plastic card that allows access to ATM and any domestic networks like EFTPOS or Interac.

Visa Electron was a debit card product that uses the Visa payment system. It is offered by issuing banks in every country with the exception of Canada, Australia, Argentina, Ireland and the United States. The difference between Visa Electron and Visa Debit, a similar product, is that payments with Visa Electron always require on-line electronic authorisation, and typically require that all the funds be available at the time of transfer, i.e., Visa Electron card accounts may not normally be overdrawn. Most Visa Debit cards, on the other hand, may be processed offline, without online authorisation, and may allow transfers exceeding available funds up to a certain limit. For that reason, Visa Electron cards are more commonly issued to younger customers or customers that have poor credit. Online stores and all offline terminals do not support Visa Electron because their systems cannot check for the availability of funds. In addition to point of sale debit payments, the card also allows the holder to withdraw cash from automated teller machines (ATMs) using the Plus interbank network.

In 2001, Banque Misr began offering the cards.

Many banks have migrated away from Visa Electron and instead issue Visa Debit cards; as such, Visa Electron issuance is declining.

Visa Electron has been discontinued globally in 2024. It has been replaced with Visa Debit.

Visa Europe has designed the V PAY bank card for European consumers based on a chip and a PIN. The V PAY card makes it possible to pay in the shops and withdraw money from distributors all over Europe. V PAY thus contributes to the establishment of a Single European Payments Area (SEPA). As the first SEPA compliant product, the V PAY card uses the particularly secure EMV chip.

Thanks to the reliability of the EMV technology, V PAY offers two decisive advantages in terms of security:

- With V PAY, transactions take place only by chip and PIN - the account data required for payment and found on the magnetic strip can no longer be abused (so-called "skimming") . Since the launch of this V PAY product in 2007, no case of skimming fraud has been recorded. Only supplementary services such as the printing the account statements or the opening of the door are still done via the magnetic strip

- V PAY - as a chip-based payment process - excludes fraudulent use from a forged card. ATMs detect the absence of chips and therefore do not accept card copies.

V PAY is therefore a cross-border bank card solution that is both simple and secure, ideal for everyday use. V PAY cards can be used at millions of merchants and thousands of ATMs across Europe. V PAY cards are accepted all over the world, where EMV chip and PIN technology is available.

Cybersource is an American payment gateway founded in 1994.

In November 2007, Cybersource acquired the U.S. small business payment services provider Authorize.net for $565 million.

On April 22, 2010, Visa Inc. acquired Cybersource for $2 billion.

Visa Risk Manager is a web portal that provides a comprehensive suite of fraud and risk management tools that can be accessed through Visa Online 24/7. It is specifically designed to help issuers optimize fraud loss prevention and maximize profitability by providing clients with an effective transaction risk management decisioning system. From defining the parameters used to flag a transaction for review, to establishing rules to decline a transaction based on the potential for fraud, Visa Risk Manager enables intelligent decisioning throughout the entire transaction lifecycle.

Cross-border solutions that can enable funds delivery across Visa’s card network and numerous domestic Automated Clearing House (ACH) and real-time payment (RTP) networks.

Visa B2B Connect is an innovative multilateral payment network, offering you an alternative cross-border solution that can address the unpredictability associated with the current correspondent banking processes.

Currencycloud is Visa’s solution to empower Banks, Fintechs, and FX Brokers to offer multi-currency services quickly and easily through a ready-made suite of solutions, embedded in your software via APIs.

Pismo is a technology company providing an all-in-one processing platform for banking, payments, and financial markets infrastructure. Large banks, marketplaces, and fintech companies use our cloud-native microservices platform to launch next-generation solutions and move from legacy systems to the most advanced technology in the market. The Pismo cloud-based platform empowers firms to build and launch financial products rapidly, scaling as they grow to have a broader audience while keeping high security and availability standards.

Jan. 16, 2024-- Visa (NYSE:V) announced it has completed its acquisition of Pismo.

Sep 26, 2024-- Visa (NYSE: V) today announced it has signed a definitive agreement to acquire Featurespace, a developer of real-time artificial intelligence (AI) payments protection technology that prevents and mitigates payments fraud and financial crime risks.

Since its inception out of Cambridge University’s engineering department, Featurespace has developed innovative algorithmic-based solutions to analyze transaction data and detect even the most elusive fraud cases.

Articles

The one operating number, by the way, that I tend to look at that we publish is processed transaction volume growth. So to me that strips away a lot of the volatility of at any moment in time what's happening with purchase mix across categories, what's happening to gas prices, what's happening in currency pairs, and really is a more pure reflection of who's using our network, how engaged are our users.

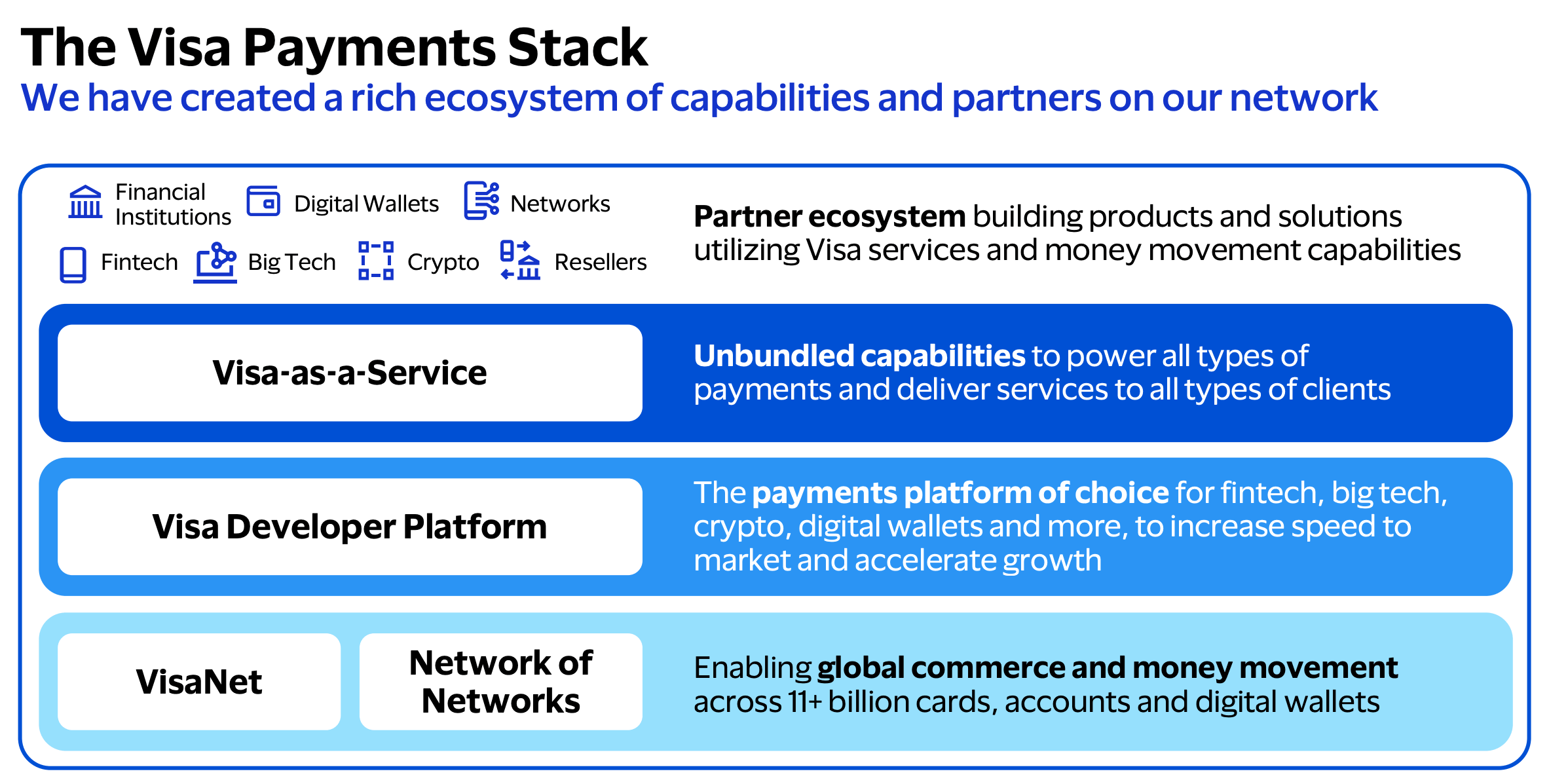

Visa as a Service is one of the most significant updates to Visa strategy since the network-of-networks strategy, I think five years ago.

We've basically taken the stack and turned it into a layered stack that our clients can use at a very base layer is our global connectivity, connectivity of 150 million points of merchant sale, connectivity to almost 5 billion credentials. So, when you use our stack, you plug in, you immediately get access to all of that.

Next layer up, services. Think about our authorization, clearing, settlement, the level of resiliency and performance that goes into that, but we've also been building new services, microservices for issuer processing, acceptance processing, risk management services, the full gamut.

And the next layer up, solutions, bundling together those services to create packaged solutions that our clients and developers can get on the platform and instantly consume and deploy, again, and get all the way back to that connectivity of 150 million merchants, 5 billion credentials through those packaged services.

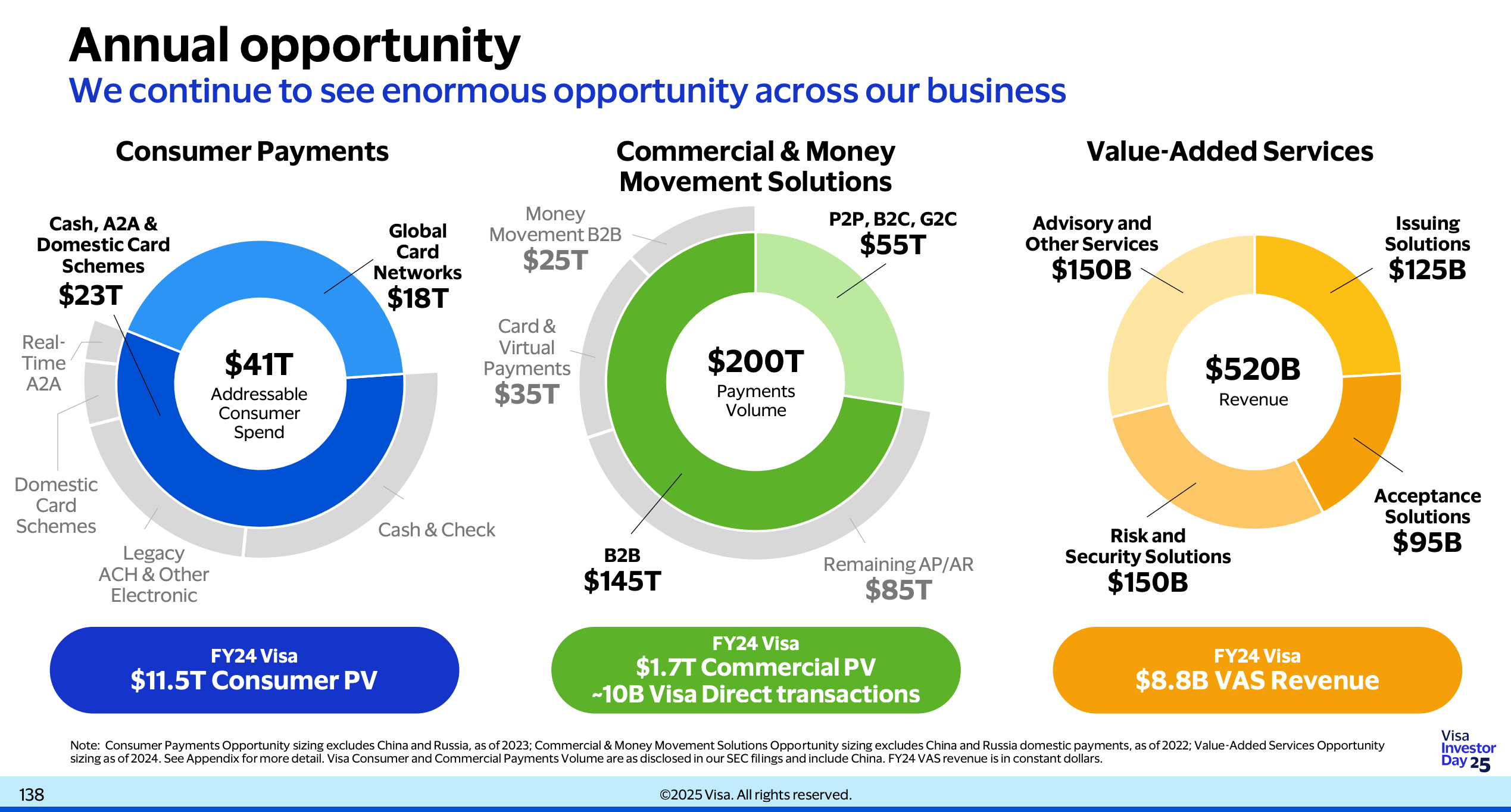

The bottom line is there is still an enormous accessible TAM out there of $23 trillion worth of cash, check and ACH payments that we view as the market opportunity that enables us to grow faster everywhere in the world above that basic level of PCE growth that's true in the United States, that's true everywhere else.

We're at 78% penetration at the physical point of sale for Tap transactions. When we get users converting to Tap, we see meaningful lifts in cash conversion and meaningful lifts in spend per active card.

You can think Flex Credential as like a Swiss Army knife of credentials. It is a credit card, it is a debit card, it is buy-now, pay-later, it's pay with rewards. It's pay with multiple currencies, all on one single physical or digital credential.

A2A = Account to Account.

We participate in account-to-account in three different ways.

- One, we obviously compete with it, and that's what I was just talking about, a whole bunch of ways in which we do that quite effectively.

- But we also use the A2A rails to initiate and process transactions ourselves, and then

- we supply services to others who are initiating and processing account-to-account transactions.

We acquired Tink several years ago. We saw the opportunity to participate in the emerging open banking payments market in Europe. We acquired Tink as our platform for doing that, and we're excited about the progress we've made. Tink is operating in nearly 20 different countries in Europe, connected to about 10,000 merchants for the purposes of pay-by-bank payment initiation.

We recently announced that we're launching an open banking payment initiation service in Brazil called Visa Conecta. And that capability is going to enable us to start to initiate Pix-based transactions for our clients in Brazil.

That account-toaccount settled transaction doesn't come with all of the feature and function that comes with a Visa transaction. It doesn't come with the security, it doesn't come with the trust, it doesn't come with the problem resolution mechanisms, the data payloads. And so, we thought about, well, how can we take everything that we do within the Visa network and start to make that available for the purposes of these account-to-account transactions?

Visa Account-to-Account Protect, which does exactly what I just said, at the transaction level, can detect fraud on account-to-account transactions, highly performative in capturing fraud. We've deployed it in Argentina, we've tested it successfully in the UK and a number of our clients in Brazil are actually using it to manage their Pix transaction risk.

There's also, at this moment in time, just a lot more uncertainty about how Open Banking is going to play out in the US from a regulatory standpoint, very much unlike Europe, where there's a very clear regulatory regime around it, or Brazil where there's a very clear regulatory regime around it. Here, there's just less certainty.

On the acquiring side, think about capabilities like our Cybersource gateway and risk management services, our Authorize.net capability, our consumer authentication services.

On the issuing side, it's capabilities like our DPS issuer processing, our Pismo core banking and issuer processing services, our loyalty services.

But we're at about 50% tokenized digital transactions, e-commerce transactions today, which is fantastic. But that means we've got 50% to go, and a big part of that 50% is tokenizing guest checkout and tokenizing form-fill transactions.

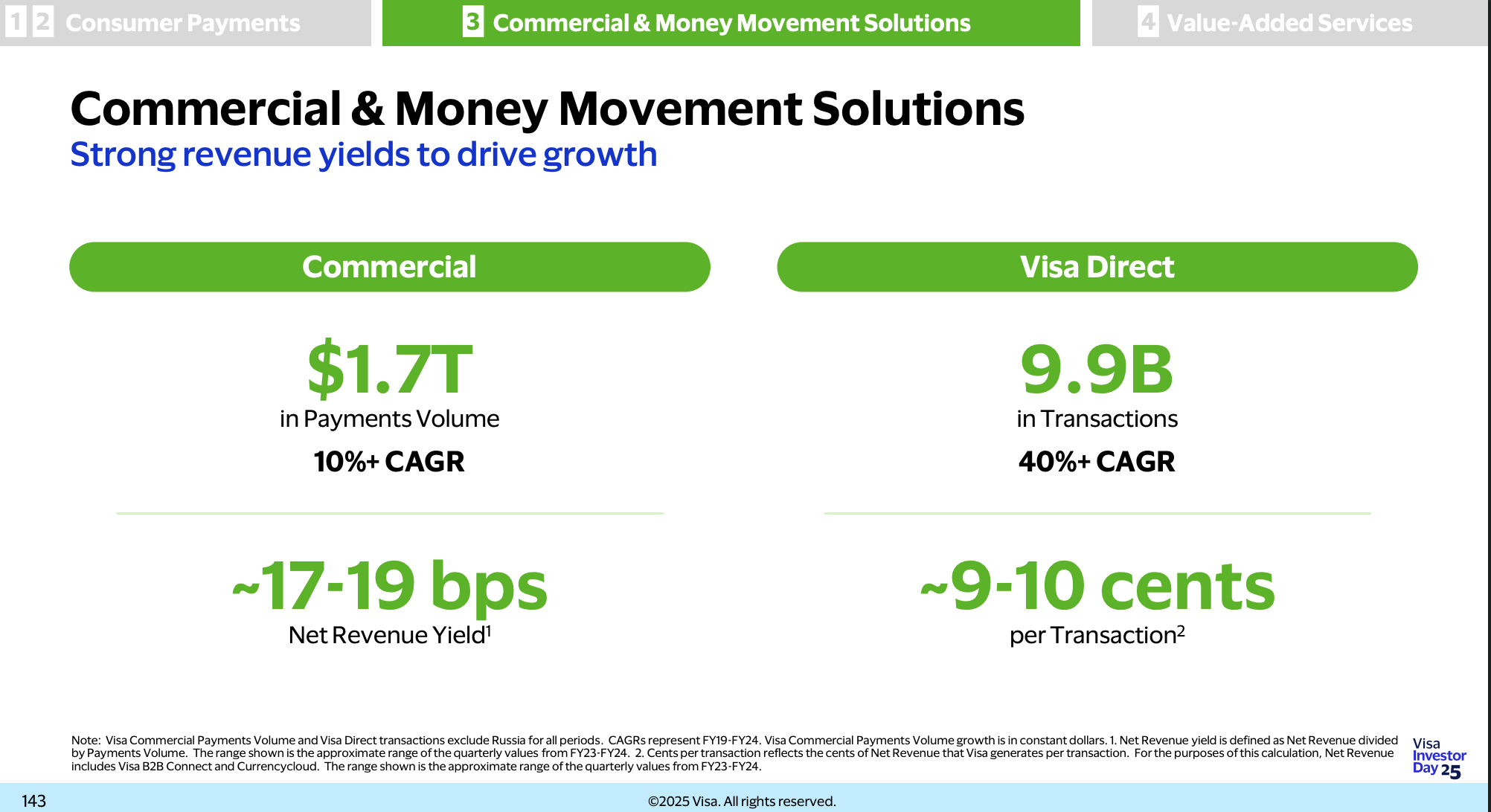

I wanted to touch on the Visa Direct business. It continued to be a major driver of growth, 25% transaction growth in the most recent quarter. The Investor Day cited several high growth use cases, including things like earned wage access and payouts. So, first I want to talk about this in a domestic context because, there are alternatives to Visa solutions in payouts, things like real-time pay-outs and A2A solutions. What's the strategy for competing with providers that leverage some of these competing form factors and what differentiates Visa Direct from these other rails?

But we knew that unlike a pull transaction, when you're sending money, you need to have even more ubiquitous coverage than the 5 billion. So, we've added bank accounts. We've added wallet capability.We've labored for many years to create that connectivity. And we now have a comprehensive network that, yes, can access those 5 billion endpoints using Visa credentials, but can also get to 11 billion total endpoints using bank accounts, wallets and other payment networks. So that ubiquity is a unique feature of Visa Direct.

RTP = Real-Time Payments(实时支付)

Don't see a lot of demand for the consumer, the merchant side, at least not yet. Do see a lot of demand for other use cases. Obviously, there's capital markets. That's a massive number, that's not necessarily our focus, but we're seeing more and more demand in other use cases, like the holding of US dollar denominated funds in markets outside of the US growing rapidly, the use of stablecoins as a more efficient mechanism for moving money across borders is growing.

We're taking those learnings and integrating them with our product development capability and our partnership efforts and focusing on areas like on-ramping and off-ramping. People want to hold US dollar-based stablecoin deposits in other countries, but when it comes to using that money, they want to off-ramp it back into their local currency. So, we're providing those on-ramps, we're providing those off-ramps

we're offering them the opportunity to settle on our network in stablecoins. We started that several years ago with USDC. We've added EURC, we've added PYUSD and USDG now. We're operating on four blockchains. Last time I talked about it publicly, we were at a run rate of about $250 million a year in stablecoin settlements. I checked in with the team just the other day, we're at about $1 billion now. So, just in the space of several months, we've quadrupled the amount of volume that we're doing in the stablecoin settlement space.

We've got to stage liquidity all over the world to make sure that we're replicating real time, even though the world's underlying settlement infrastructure isn't real time. We're using stablecoins to start to solve that problem and create more efficiency for us. And lastly, we're building capabilities for our clients to enable them to offer tokenized assets, deposits and stablecoins to their own customers through our Visa Tokenized Asset Platform.

- 2025-06-18 Yellow Card Partners with Visa to Accelerate Stablecoin Adoption Across Emerging Economies

Yellow Card, the leading licensed stablecoin payments orchestrator for Africa and the emerging world, announced a partnership with Visa (NYSE: V), a global leader in digital payments, to help drive the next phase of innovation in cross-border payments and financial infrastructure across emerging markets where Yellow Card is licensed to operate.

Through this partnership, Visa and Yellow Card will collaborate to explore stablecoin use cases and opportunities to help streamline treasury operations, enhance liquidity management, and enable faster, more cost-effective money movement across borders.

Yellow Card operates in 20+ African countries and provides access to secure, compliant, and accessible stablecoin products for consumers, businesses, and developers.

Visa (NYSE:V), a global leader in digital payments, and Bridge, a leading stablecoin orchestration platform and a Stripe company, today announced a new card-issuing product. Fintech developers using Bridge can now offer stablecoin-linked Visa cards to their end customers in multiple countries through a single API integration.

Cardholders will be able to make everyday purchases from a stablecoin balance at any merchant location that accepts Visa. For example, when a customer in Colombia shops locally and uses their Bridge-enabled Visa card to pay a merchant, Bridge deducts the requisite funds from the customer’s stablecoin balance and converts the balance into fiat, enabling the merchant to get paid in their local currency like any other transaction. Customers can add these cards to supporting digital wallets and pay at the 150M+ merchant locations that accept Visa.

Developers building with Bridge can now easily add stablecoin-linked Visa cards to their product offerings and manage these programmatically through Bridge in multiple countries. Behind the scenes, Bridge moves and converts stablecoins from and to those cards on behalf of developers. Bridge is working with Lead Bank as a financial institution partner.

The integration enables issuance of new card programs in multiple countries at once, starting with Argentina, Colombia, Ecuador, Mexico, Peru and Chile. The focus on Latin America aims to address the growing demand for consumers and businesses to utilize stablecoins to store value and fund everyday purchases. Availability will expand to countries in Europe, Africa and Asia in the coming months.

The combined, global company provides digital payment products, services and processing to about 17,100 financial institution clients and partners, 40 million merchant outlets, and 3.0 billion Visa cards worldwide. Visa–branded cards and payment products enable approximately $6.8 trillion in global payments volume annually.

At the closing of the transaction (the "Closing"), the Company:

- paid up-front cash consideration of €12.2 billion ($13.9 billion);

- issued preferred stock of the Company convertible upon certain conditions into approximately 79 million shares of class A common stock of the Company, as described below, equivalent to a value of €5.3 billion ($6.1 billion) at the closing stock price of $77.33 on June 21, 2016; and

- agreed to pay an additional €1.0 billion, plus 4% compound annual interest, on the third anniversary of the Closing.

Quarterly Results

2026Q1

Current year's results included special items of

- $707 million for a litigation provision associated with the interchange multidistrict litigation ("MDL") case and

- $333 million for a deferred tax benefit recognized due to a change in the U.S. taxation of certain foreign earnings. Current year's results also included

- $7 million of net losses from equity investments and

- $66 million from the amortization of acquired intangible assets and acquisition-related costs.

Prior year's results included special items of

- $213 million for severance costs,

- $39 million for lease consolidation costs and

- $27 million for a litigation provision associated with the MDL case. Prior year’s results also included

- $75 million of net losses from equity investments and

- $80 million from the amortization of acquired intangible assets and acquisition-related costs.

Excluding these items and related tax impacts, non-GAAP net income for the quarter was $6.1 billion or $3.17 per share, increases of 12% and 15%, respectively.

During the three months ended December 31, 2025, Visa repurchased approximately 11 million shares of class A common stock at an average cost of $342.13 per share for $3.8 billion. The Company had $21.1 billion of remaining authorized funds for share repurchases as of December 31, 2025.

2025Q4

Current year's results included a special item of $899 million for a litigation provision associated with the interchange multidistrict litigation ("MDL") case and other legal matters. Current year's results also included $46 million of net gains from equity investments and $66 million from the amortization of acquired intangible assets and acquisition-related costs.

In full year 2025, we expanded our network of networks in three important ways. First, more connection points. Visa's network of networks now has approximately 12 billion endpoints, that's about 4 billion cards, bank accounts, and digital wallets each.

Second, more settlement currencies. We are adding support for four stablecoins running on four unique blockchains representing two currencies that we can accept and convert to over 25 traditional fiat currencies.

Our stablecoin platform is another key component of our services layer. Since 2020, we've facilitated over $140 billion in crypto and stablecoin flows, including Visa users purchasing more than $100 billion of crypto and stablecoin assets using their Visa credentials and spending more than $35 billion in crypto and stablecoin assets using Visa credentials.

Within this, we see particular momentum with stablecoins. We now have more than 130 stablecoin-linked card issuing programs in over 40 countries. And in Q4, stablecoin-linked Visa card spend quadrupled versus a year ago. We expanded the number of stablecoins and blockchains available for settlement and monthly volume has now passed a $2.5 billion annualized run rate.

We are starting to enable banks to mint and burn their own stablecoins with the Visa Tokenized Asset Platform, and we are adding stablecoin capabilities to enhance cross-border money movement with Visa Direct.

In September 2025, we announced a stablecoin prefunding Visa Direct pilot targeting banks, remitters, and financial institutions seeking faster, more flexible ways to manage liquidity, and there is much more to come in this space.

Just two weeks ago, we announced the Visa Trusted Agent Protocol, a framework that enables safer agent-driven checkout by helping merchants verify agents and avoid malicious bots. And since it's built on existing messaging standards, minimal integration is required for merchants.

Our transit initiatives contributed to this expansion, and this year, we enabled more than 100 new transit systems to now total approximately 1,000 systems globally, delivering 19% year-over-year growth in transactions.

Our purpose-built travel solution offers virtual card credentials, automated reconciliation and rich data. We recently won Trip.com's global virtual travel card issuing business, which will be issued through their fintech TripLink.

In fact, in India, Visa SMB cards have doubled since 2020 and now total more than 10 million, helping us to grow total commercial cards to 340 million worldwide.

Touch 'n Go eWallet, the largest wallet in Malaysia with more than 24 million users will leverage Visa Direct to enable tourists to fund their wallets across eight corridors.

This quarter, we signed with Booking.com for TMS and Account Updater across more than 65 markets, deepening our presence in the online travel platform space.

I want to thank our more than 34,000 employees around the world ...

In 2026, we expect full year adjusted net revenue growth to be in the low-double digits.

In terms of quarterly variability of net revenue, two items I would call out. First, we expect Q1 to have the highest year-over-year net revenue growth rate, primarily due to the timing impact of our FY 2025 pricing actions. Second, we expect Q3 to have the lowest year-over-year net revenue growth rate, primarily due to the lapping impacts of strong volatility and lower-than-expected incentives in Q3 of 2025.

We currently expect to grow adjusted operating expense in the low-double digits, consistent with our net revenue growth. As we think about the cadence of spend, we expect Q2 and Q3 to have the largest year-over-year growth rates as a result of marketing expense related to the Olympics and FIFA.

In 2026, we still expect to be below our long-term tax rate. When we incorporate our current tax planning strategies, we expect the tax rate to be between 18.5% and 19%, up from 2024 and 2025, primarily due to the absence of one-time benefits.

On capital return, the board has declared an increase to our quarterly dividend by 14%, and we intend to return excess free cash flow to shareholders through buybacks. All of this results in our adjusted EPS growth to be in the low double-digits.

We expect Q1 adjusted net revenue growth in the high end of low doubledigits. We expect adjusted operating expense growth in the low double-digits.

Non-operating expense is expected to be about $15 million. And our tax rate in the first quarter is expected to be around 18%. As a result, we expect adjusted first quarter EPS growth to be in the low-teens

agentic commerce

I was wondering if you could talk about some of the differences and similarities between Visa's Trusted Agent Protocol and Stripe's Agentic Commerce Protocol. I mean, anything you could talk about in terms of what layer of the value chain you're tackling and how your offering is differentiated versus theirs?

And part of the reason for that is that the e-commerce part of the – mix of the volume is bigger. It was about a third of the business pre-COVID. It's about 40% now and continue to grow at a faster clip than travel. And so should that trend continue, we'll continue to see a bigger weight toward the e-commerce side of the business.

And short answer to your question is we see opportunities in issuance, in modernizing our settlement network. I think I talked about some of the opportunities we've captured with our Pismo platform. As you said, we're leveraging stablecoins in cross-border money movement. We announced the Visa Direct prefunding work. We're minting and burning on behalf of our clients with the Visa Tokenized Asset Platform. We've been working with our clients in our consulting business with stablecoins. I mean the list goes on and on.

But just stepping back, as I've said, the areas where there's product market fit for stablecoins in the world are the areas where there's significant TAMs and largely where we're underpenetrated. And that's emerging markets. And that's cross-border money movement.

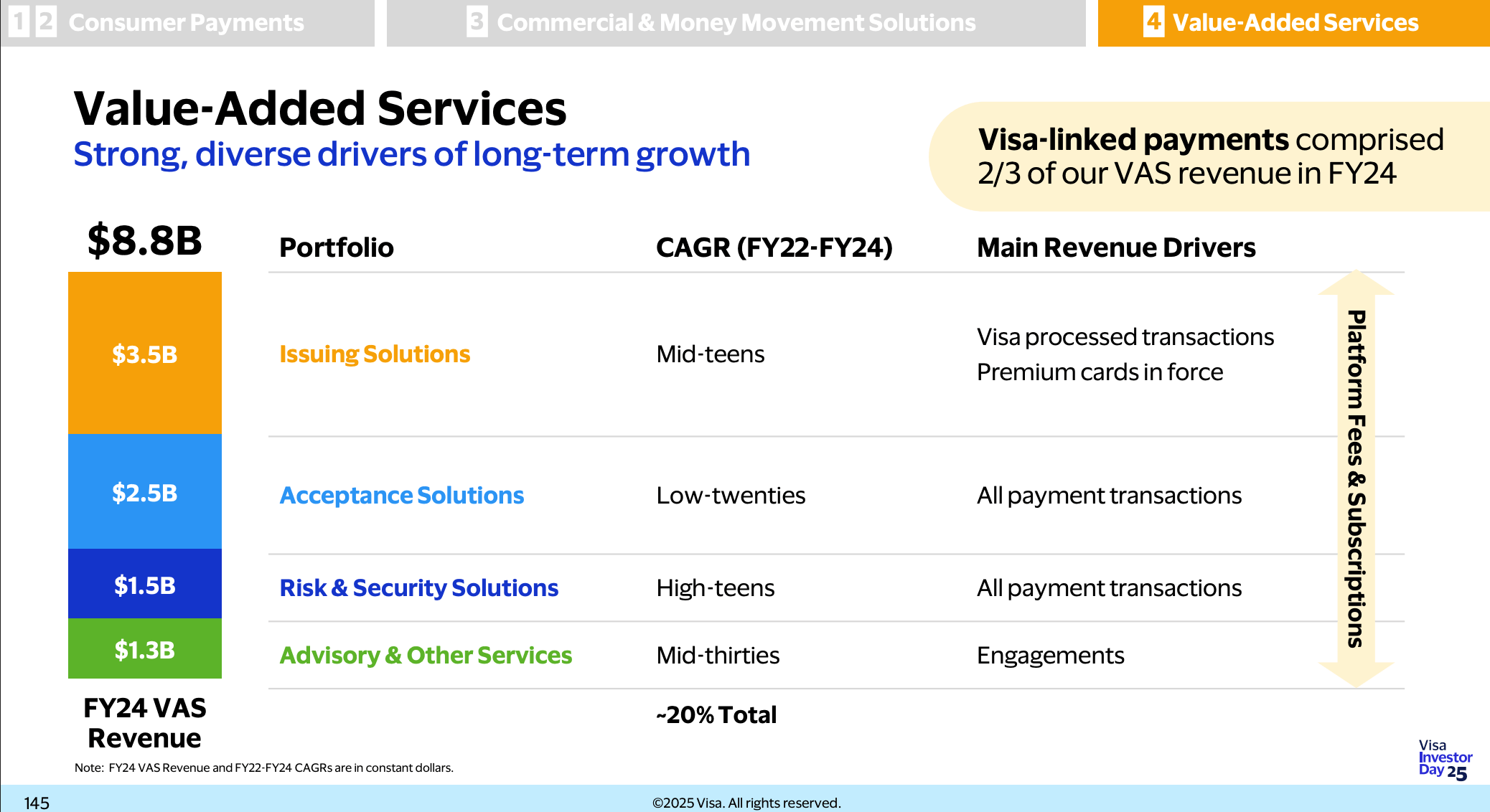

Just looking at it numerically, it looks like the biggest change really is, a few years ago, not too long ago, value-added services was about 20% of revenue growing in the high-teens, and now it's approaching 30% of revenue and growing in the mid-20s. So the growth contribution has stepped up at least 200 basis points, if not closer to 300 basis points.

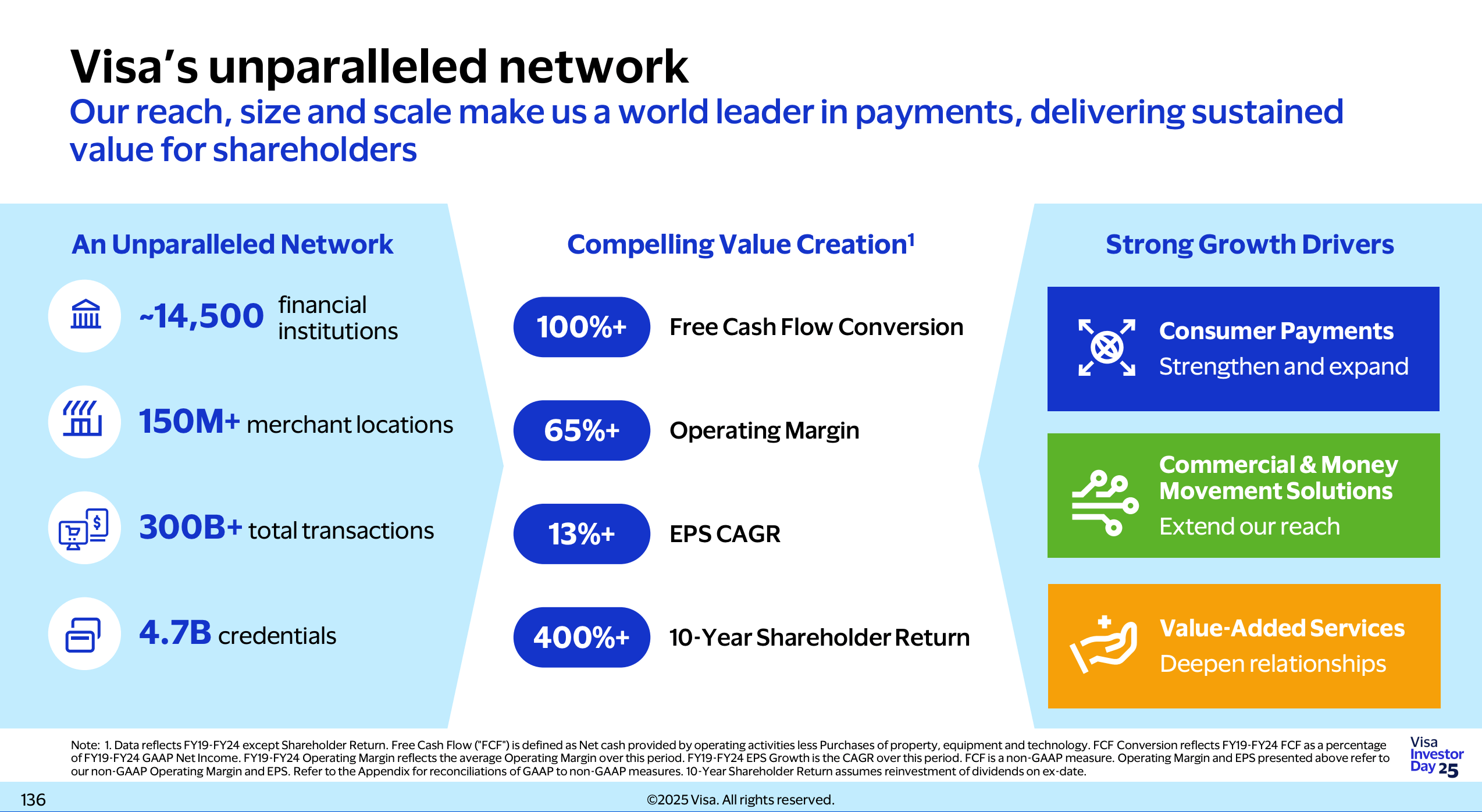

We focus on driving revenue across consumer payments, VAS and CMS.

2025Q3

On May 15, 2025, Visa issued fixed-rate senior notes in an aggregate principal amount of €3.5 billion with maturities ranging between 3 and 19 years, and interest rates from 2.250% to 3.875%. The Company intends to use the net proceeds for general corporate purposes, which may include, among other things, the refinancing of existing indebtedness.

During the three months ended June 30, 2025, Visa repurchased approximately 14 million shares of class A common stock at an average cost of $349.24 per share for $4.8 billion. The Company had $29.8 billion of remaining authorized funds for share repurchases as of June 30, 2025.

On July 29, 2025, the board of directors declared a quarterly cash dividend of $0.590 per share of class A common stock (determined in the case of all other outstanding common and preferred stock on an as-converted basis) payable on September 2, 2025, to all holders of record as of August 12, 2025.

Three growth engines

- Consumer payments

- Commercial & Money Movement Solutions

- Value-added services

- Issuing Solutions

- Acceptance Solutions

- Risk & Security Solutions

- Advisory & other services

We renewed our agreement with ShopeePay, a leading digital payments platform serving tens of millions of users and expanded geographically from Singapore, Malaysia, and Vietnam, to include the Philippines, Indonesia and Thailand, and also expanded with additional products such as tokenization.

StableCoin

We believe that Visa's role is to do what we always do: provide trust, standards, connectivity, billions of endpoints, scale, and interoperability to the payments ecosystem.

Beyond capital markets use cases, we see product market fit for stablecoins in two important areas: one, in emerging markets where the local fiat currency is volatile and/or where consumers do not have easy or affordable access to US dollars; and two, in cross-border money movement, both B2B payments and consumer remittances.

We have deployed stablecoin-linked cards in many markets around the world with partners such as Bridge, Rain and Baanx.

Since 2020, we have enabled crypto users to spend more than $25 billion in Bitcoin, Ethereum and an array of other cryptocurrencies, and now stablecoins.

We are also enabling cross-border money movement capabilities for P2P and B2B in certain emerging markets. And we are piloting and partnering with stablecoin payments companies who specialize in these markets, as we build out our stablecoin treasury stack for settlement and money movement flows.

A recent example is with Yellow Card in Sub-Saharan Africa. Together, we are working to streamline treasury operations, improve liquidity management, and enable quick and more cost-efficient cross-border transactions. Additionally, we are also helping banks issue their own stablecoins and realize the benefits of programmable money through our Visa Tokenized Asset Platform. And we offer multi-chain and multi-coin, stablecoin settlement on the Visa network. We recently expanded our capabilities by adding a euro-backed stablecoin, EURC, and through a partnership with Paxos, two additional regulated stablecoins, USDG and PYUSD. We are also adding support for two additional blockchains, Stellar and Avalanche, enabling us to support four stablecoins running on four unique blockchains, representing two currencies that we can then accept and convert to over 25 traditional fiat currencies across the world for our clients within settlement infrastructure. There is so much more to come in this space, and we are excited about enabling commercial and money movement flows globally across networks, currencies and form factors.

The first, on the emerging markets use cases, the bulk of those markets around the world are very cash-rich markets. The bulk of those markets around the world are markets where we haven't been as successful digitizing cash as we have in more mature markets.

And so to the extent that stablecoins get adopted in a broad-based way by both consumers and businesses, and assuming that we are able to continue to have success with our playbook of making Visa cards the preferred way for people who have stablecoins in those markets to pay for things, I think that could accelerate our progress digitizing consumer payments and business, small business and commercial payments in those markets.

The second product – area of product market fit that I mentioned was cross-border. And as you know well, the cross-border TAM in terms of whether it's remittances or B2B money movement, those are enormous TAMs that we're still relatively low in terms of our penetration of those as well. And so I think to the extent that we can do the types of things I was mentioning in the question that Will asked earlier for remittances on our Visa Direct platform, that's going to be an opportunity for us to continue to expand and accelerate our growth in remittances.

Visa Investor Day 25

Visa Investor Day 2025: Full Presentation (PDF)

- Consumer Payment:

- Tap to Everything

- Token Technology

- Cross-Border

- Affluent Consumers

- A2A Products and Services

- Powering Credit

- Commercial & Money Movement Solutions

- Visa Commercial Solutions

- Small & Medium Business

- Large & Middle Market

- Product Innovation

- New Acceptance

- Visa Direct

- P2P, G2C, B2C, New Use Cases

- Cross-Border Flows

- Deepen Relationships with Existing Clients

- Visa Commercial Solutions

- Value-Added Service

- Issuing Solutions

- Acceptance Solutions

- Risk & Security Solutions

- Advisory & Other Services

- Consumer Payment:

2025Q2

2025Q1

2024Q4

- Visa Inc. (V) Q4 2024 Earnings Call Transcript

- Earnings Release

- Presentation

- Operational Data

- Transcript

2024Q3

- Visa Inc. (V) Q3 2024 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2024Q2

- Visa Inc. (V) Q2 2024 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2024Q1

- Visa Inc. (V) Q1 2024 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2023Q4

- Visa Inc. (V) Q4 2023 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

- Visa Annual Report 2023

2023Q3

- Visa Inc. (V) Q3 2023 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2023Q2

- Visa Inc. (V) Q2 2023 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2023Q1

- Visa Inc. (V) Q1 2023 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2022Q4

- Visa Inc. (V) Q4 2022 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

- Visa Annual Report 2022

2022Q3

- Visa Inc. (V) Q3 2022 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2022Q2

- Visa Inc. (V) Q2 2022 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2022Q1

- Visa Inc. (V) Q1 2022 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2021Q4

- Visa Inc. (V) Q4 2021 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

- Visa Annual Report 2021

2021Q3

- Visa Inc. (V) Q3 2021 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2021Q2

- Visa Inc. (V) Q2 2021 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2021Q1

- Visa Inc. (V) Q1 2021 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2020Q4

- Visa Inc. (V) Q4 2020 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

- Visa Annual Report 2020

2020Q3

- Visa Inc. (V) Q3 2020 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2020Q2

- Visa Inc. (V) Q2 2020 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2020Q1

- Visa Inc. (V) Q1 2020 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2019Q4

- Visa Inc. (V) Q4 2019 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

- Visa Annual Report 2019

2019Q3

- Visa Inc. (V) Q3 2019 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2019Q2

- Visa Inc. (V) Q2 2019 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2019Q1

- Visa Inc. (V) Q1 2019 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2018Q4

- Visa Inc. (V) Q4 2018 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

- Visa Annual Report 2018

2018Q3

- Visa Inc. (V) Q3 2018 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2018Q2

- Visa Inc. (V) Q2 2018 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2018Q1

- Visa Inc. (V) Q1 2018 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2017Q4

- Visa Inc. (V) Q4 2017 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2017Q3

- Visa Inc. (V) Q3 2017 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2017Q2

- Visa Inc. (V) Q2 2017 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2017Q1

- Visa Inc. (V) Q1 2017 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data

2016Q4

- Visa Inc. (V) Q4 2016 Earnings Call Transcript

- Earnings Release

- Presentation

- Transcript

- Operational Data